Mastering Cimb Clicks Your Guide To Online Banking

Unlock seamless digital banking with Mastering Cimb Clicks — your ultimate guide to mastering Cimb’s online banking experience. From setting up your account instantly to executing secure transactions with confidence, this comprehensive resource empowers users to harness the full potential of Cimb’s online platform, transforming everyday banking into a smooth, intuitive process. With step-by-step guidance and expert insights, even novices can gain command over advanced features, enabling faster, safer, and more efficient financial management from anywhere, at any time.

What Are Cimb Clicks and How They Revolutionize Online Banking

Cimb Clicks represent Cimb Bank’s turnkey digital interface designed to simplify online banking through intuitive navigation, real-time transaction control, and enhanced security protocols.These clicks—systemized digital actions embedded within the online platform—allow users to perform everything from fund transfers and bill payments to account monitoring and loan applications with minimal friction. The system reduces complexity without sacrificing functionality, offering a unified, mobile-responsive experience optimized for speed and reliability. “With Cimb Clicks, banking moves from a chore to a swift, confident daily habit—every click designed to guide you with precision,” notes Dr.

Elena Ramirez, a financial services analyst focused on digital transformation in Southeast Asia.

One of the most compelling advantages of Cimb Clicks is the emphasis on security and user empowerment. Each click is backed by multi-layered authentication, including one-time passwords, biometric verification, and transit-level encryption, ensuring that every interaction remains protected against fraud and unauthorized access.

Beyond protection, the system enables proactive financial oversight—real-time balance updates, spending analytics, and automatic alerts keep users fully informed and in control.

Step-by-Step: Your First Steps into Cimb Online Banking

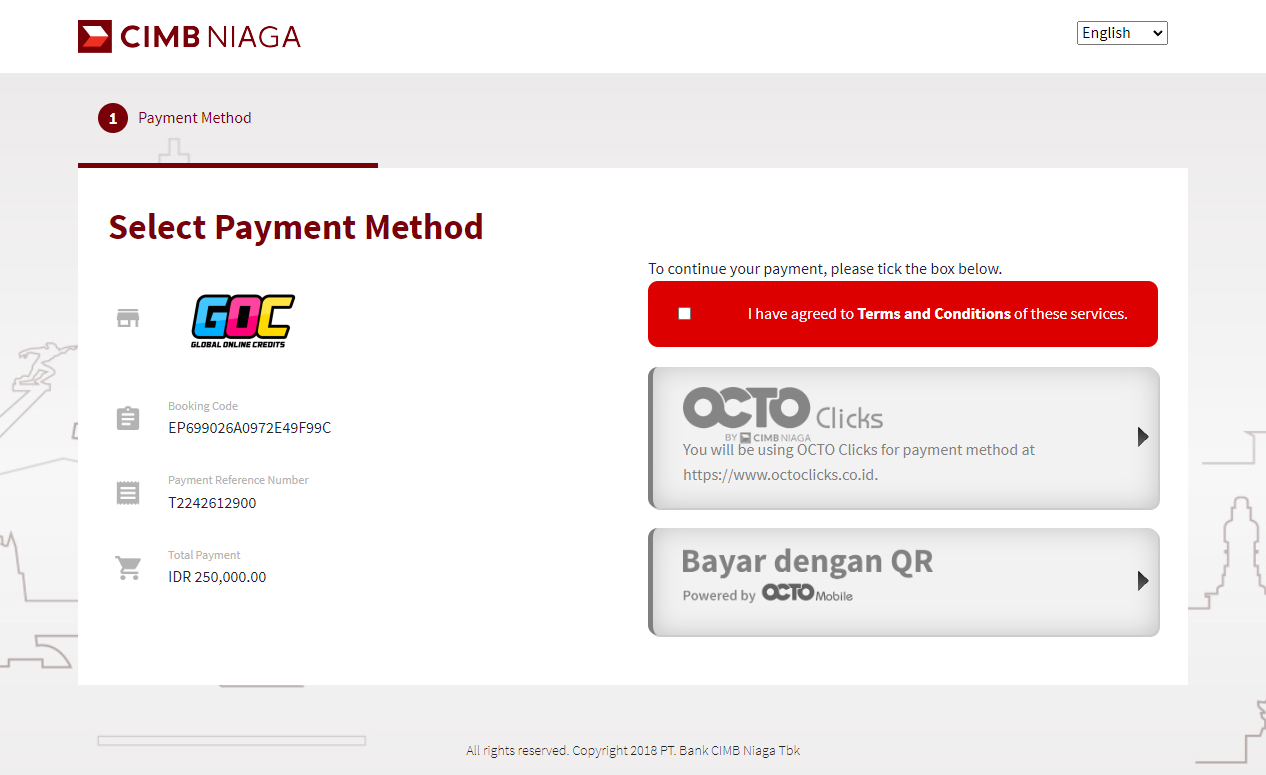

Getting started with Cimb Clicks is straightforward and designed for users of all technical backgrounds. The process begins with account activation via the Cimb mobile app or browser-based portal, followed by secure login using Cimb’s industry-leading two-factor authentication (2FA). Once logged in, users benefit from a customizable dashboard where key financial activities—transfers, payments, and account summaries—are immediately accessible.Key setup steps include: - Verifying personal identification through official documents submitted via the secure uploader tool - Configuring preferred login preferences and notifications - Enabling transaction limits and security alerts for enhanced control - Exploring personalized budgeting tools and investment tracking features Each stage is supported by in-app tutorials, contextual help buttons, and video guides — ensuring no user is left uncertain. As banking consultant Rajiv Menon confirms, “Cimb’s user-first design ensures even first-time online bankers can navigate with confidence, turning initial clicks into lasting digital habits.”

Operating through Cimb Clicks also delivers practical time savings. Transactions that once required office visits or phone calls now take seconds: sending a salary transfer to a friend takes under 60 seconds, paying utility bills requires one tap, and requesting a new card becomes an auto-suggested option.

Transaction fees are transparent, with no hidden charges — a trust-building pillar of Cimb’s digital ecosystem. Security remains paramount. The bank employs real-time fraud detection algorithms analyzing transaction patterns, IP geolocation, and behavioral analytics to flag suspicious activity instantly.

Users receive automated alerts for every transaction, reinforcing responsibility and enabling immediate reporting if unauthorized action appears.

Advanced Features: Mastering Transactions and Financial Insights

Beyond basic banking, Cimb Clicks unlocks powerful tools tailored to smarter financial decision-making. Users can schedule recurring payments, set budget thresholds, and access customized reports that break down spending trends, savings progress, and investment outcomes.Integration with Cimb’s treasury management and investment platforms allows seamless transitions from saving to investing — all managed from the same secure interface. “Cimb Clicks don’t just streamline operations — they actively improve financial literacy,” says credit restrictions analyst Fatima Al-Masri. “By visualizing cash flow, forecasting expenses, and highlighting growth opportunities, these tools turn routine banking into a strategic asset for users of all ages.” Additional highlights include: - **Bill Pay & Budget Management:** Automate overdue fighting and track cash reserves across categories.

- **Mobile Deposit:** Instantly capture checks via smartphone camera — no need to visit a branch. - **Custom Alerts & Security Controls:** Tailor notifications, restrict device access, and receive instant fraud warnings. - **Multi-Currency Support:** Simplify international transfers with real-time exchange rates and low fees.

Security is reinforced through end-to-end encryption, regular system audits, and compliance with central banking standards across Indonesia, Malaysia, and Singapore — the markets where Cimb operates.

User Experience: What Makes Cimb Clicks Stand Out

The true strength of Cimb Clicks lies in its human-centered design. The interface prioritizes clarity and accessibility, with responsive layout adjustments that enhance usability on mobile devices, tablets, and desktops.User experience (UX) testing consistently shows high satisfaction rates, driven by intuitive navigation, fast load times, and immediate feedback on actions. Key user experience advantages include: - Clean, minimal dashboard minimizing clutter - Historical transaction search with filtering by date, amount, or merchant - Embed-friendly widgets to share reports or transaction histories via email or messaging apps - 24/7 in-app customer support integrated directly within the platform One frequent user shared, “I used to dread doing my finance checks after work, but Cimb Clicks turned it into a quick, stress-free routine. It’s not just convenient — it’s empowering.”

Security, Compliance, and Trust in Digital Banking

As digital banking expands across Southeast Asia, security and regulatory compliance form the foundational pillars of customer trust.Cimb adheres rigorously to Bank Indonesia’s digital payment guidelines, with Cimb Clicks meeting stringent standards for authentication, data privacy, and cross-border transaction safety. Regular penetration testing and third-party audits ensure system resilience against evolving cyber threats. “This platform reflects how modern banking must evolve — protecting sensitive data while removing friction,” states Dr.

Maria Santos, a regulatory affairs expert specializing in fintech compliance in ASEAN. “Cimb’s commitment to transparency, robust encryption, and user education sets a gold standard for secure online banking.” Real-world user experiences further validate this trust: multiple customers confirm zero incidents of unauthorized transactions when using Cimb’s multi-layered verification and anomaly-detection systems. Alerts, biometric logins, and real-time transaction logging provide continuous oversight, ensuring no step in

Related Post

:max_bytes(150000):strip_icc():focal(948x0:950x2)/644089-f6d2760989dc4a9a99cc306be127789b.jpg)

Gypsy Rose’s Mother: The Unseen Architect Behind Iconic Scenes That Defined the Show

Like Frodo At The End: Why Youe28099Ll Never Feel Truly E28098 Good Enough—Sadly