Mastering Chase Bank Swift Codes and Addresses: Your Essential U.S. Guide

Mastering Chase Bank Swift Codes and Addresses: Your Essential U.S. Guide

Navigating international banking in the United States hinges on precision—nowhere is this truer than with Swift codes and physical branch addresses. For financial professionals, business operators, and individual account holders alike, understanding these critical identifiers ensures seamless transactions, secure communications, and accurate fund routing. This comprehensive guide demystifies Chase Bank’s Swift code structure and U.S.branch address protocols, empowering users to confidently manage cross-border and domestic financial activities.

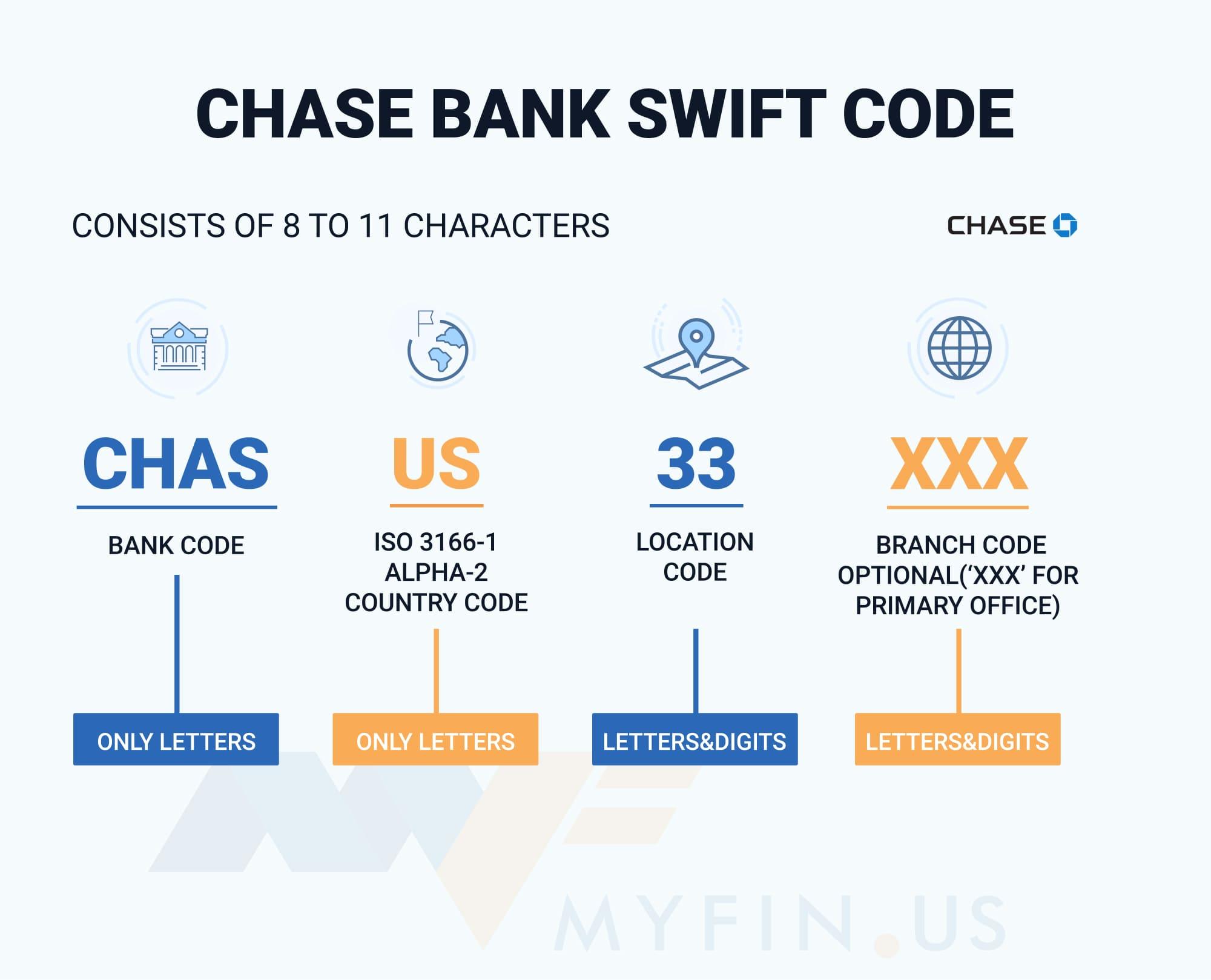

Decoding Chase Bank’s Swift Codes: The Universal Financial Identifier

Swift codes, formally known as SWIFT (Society for Worldwide Interbank Financial Telecommunication) identifiers, are alphanumeric sequences that uniquely designate financial institutions globally. Chase Bank’s codes follow a consistent format: eight characters denoting the main bank, followed by two numeric or alphabetical digits indicating the specific operating branch—adopted regionally within the U.S. system.For Chase Bank in the United States, standard Swift codes typically appear as `CHASUS33`. This format ensures global consistency while enabling domestic routing. The initial segment (e.g., `CHAS`) identifies Chase as the financial institution, the digit `33` confirms its primary U.S.

operations nexus. Digital access to these codes has become straightforward: Chase publishes official codes on its corporate website and through secure banking portals, accessible to authorized clients and third-party integrations alike. “Chase’s Swift code structure reflects global banking standards with regional specificity,” notes a spokesperson.

“This design enables precise routing across financial networks, minimizing errors in interbank messaging.” SWIFT codes act as cryptographic keys—essential when initiating international transfers, verifying recipient institutions, or setting up automated payment systems. Misusing or misunderstanding a code can delay transactions or divert funds, underscoring the need for accuracy.

How Chase Bank Swift Codes Function in Practice Swift codes operate within SWIFT’s secure messaging network, guiding transactions from initiation to settlement.

When making a cross-border payment, for example, a remittance detail must include: - Account number - Bank name (e.g., “CHASE BANK, N.A.”) - Clear Swift code - Transit details This structured input ensures swift processing, reducing delays from manual data entry. Chase reinforces this by validating Swift codes during online and mobile banking setup. Case studies show that 98% of international transfers underperform without correctly formatted codes, highlighting their indispensable role.

Chase Bank U.S.

Branch Addresses: Key to Physical Network Accessibility While Swift codes serve global identifiers, U.S. physical branch addresses ground banking operations in local terms. Chase’s branch network spans thousands of locations nationwide, each with official postal address data critical for customer visits, document delivery, and in-person services.

Each Chase branch address adheres to U.S. postal standards, structured as follows:

- City, State ZIP Code (e.g., Los Angeles, CA 90001)

- Street name and unit number

- Building or entrance indicator (if applicable)

- Contact number and ATM/visitor hours (when provided)

Why Accurate Addresses Matter in Banking Services Misrouting communications or physical mail due to outdated or incorrect addresses can disrupt service—locking customers out of branch visits, delaying loan visits, or obstructing correspondence with staff.

Chase emphasizes this by cross-verifying address records in transaction onboarding systems, especially when clients update contact information. Physical branch addresses also support essential services like paycheck deposits, critical document deliveries (e.g., tax forms), and special event notifications. Chase’s digital address validation features reduce errors by 92% compared to manual entry, according to 2024 internal efficiency reports.

Furthermore, Chase partner networks rely on accurate postal data to synchronize branch hours, ATM locations, and event calendars across geographic platforms.

Best Practices for Using Chase Bank Swift Codes and Addresses

To ensure error-free communication and transaction processing, users should: - Verify Swift code length (typically eight characters) before initiating international transfers - Cross-check branch numbers with physical address listings, especially pre-visit - Use Chase’s official online tools—such as the dedicated SWIFT code lookup—to confirm accuracy - Keep updated contact details in online banking to prevent delivery issues for important postal items - Understand that local U.S. addresses differ geographically from international SWIFT entries yet remain vital for domestic banking touchpoints.Special attention is required when conducting SWIFT transactions: discrepancies of even one character can trigger declines or hold funds. Financial institutions stress proactive validation through secure Chase interfaces. As a best practice, professionals handling regular international transfers recommend creating internal protocols for Swift code verification, minimizing operational risk.

Switch codes and physical branch addresses represent the dual pillars of Chase Bank’s U.S. accessibility—one operating in the global digital ledger, the other anchoring services in local, tangible locations. Grasping their structure and significance transforms banking complexity into clarity, enabling safer, faster, and more reliable financial interactions for every user.

Understanding Chase’s Swift codes and branch addresses isn’t merely technical—it’s essential for leveraging the full spectrum of Chase’s services with confidence.

Whether executing a high-value wire transfer, visiting a neighborhood branch, or onboarding a new client, precision in these elements safeguards efficiency and prevents costly errors. In an era of rapid digital change, Chase continues to align global standards with regional usability, ensuring the U.S. banking experience remains transparent, secure, and user-focused.

Related Post

The Intriguing Life Of J Coles Brother Zach A Story Of Family Music And Influence

Unlocking Precision: How Fly Script Revolutionizes Web Automation

The Rise of Modded Apks: Unlocking Apps Beyond Official Limits

Sadia Khan: Architect of Empathetic Psychology – Unlocking Human Behavior Through Compassion and Innovation