Master Your California Sales Tax: Unlock Accuracy with the Official Calculator Tool

Master Your California Sales Tax: Unlock Accuracy with the Official Calculator Tool

When purchasing goods across California, navigating sales tax can feel like decoding a complex puzzle—especially with varying rates, exemptions, and nexus rules. Yet, for businesses and savvy consumers alike, the California Sales Tax Calculator offers a reliable shortcut. This advanced tool streamlines the process of determining tax liabilities, transforming confusion into clarity.

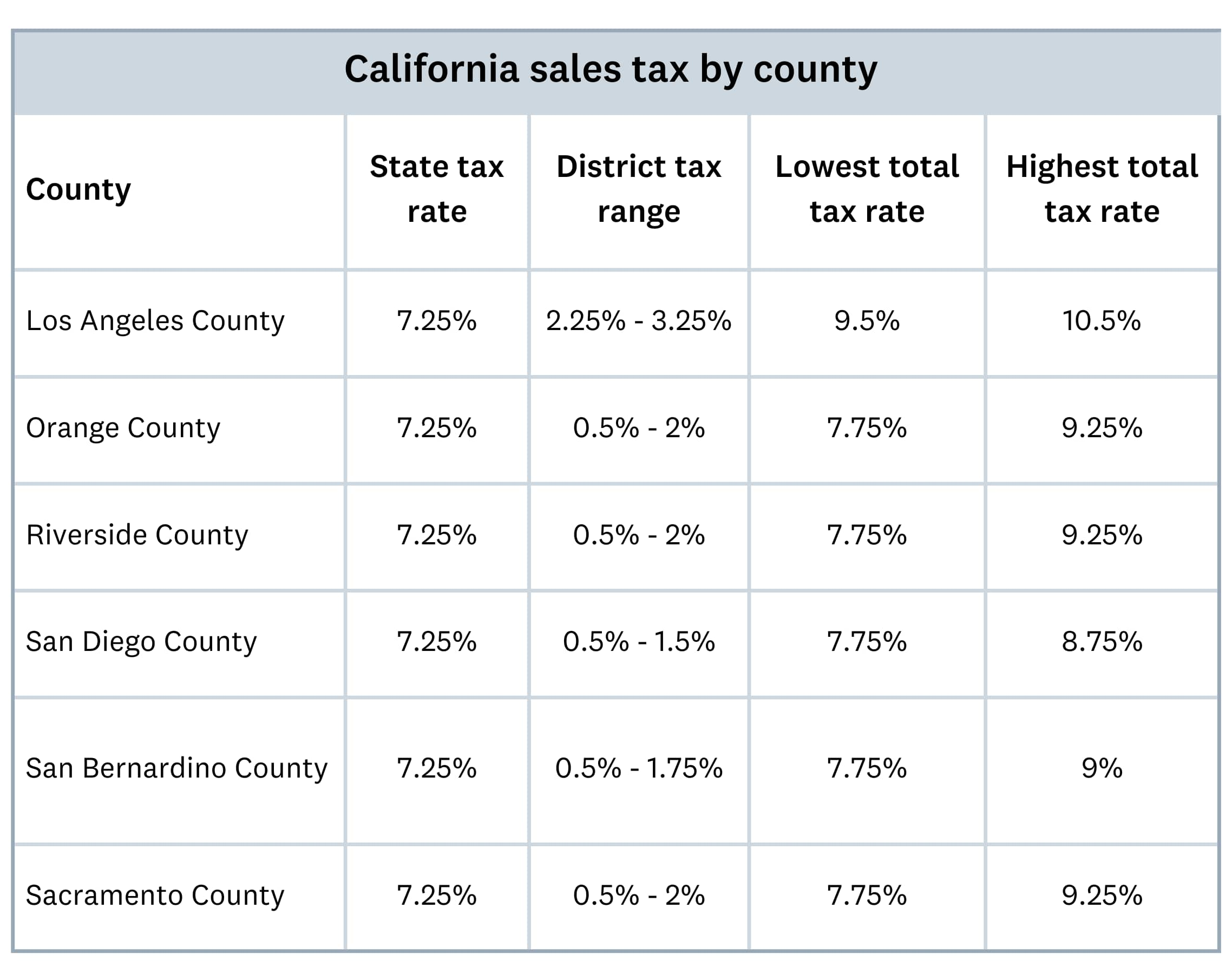

Whether you're a small retailer managing inventory or a shopper budgeting for a big purchase, understanding how to use this calculator ensures compliance and prevents costly miscalculations. The California sales tax system is administered by the Department of Tax and Fee Administration (DTFA), with rates currently set at 7.25% state-wide, plus local district taxes that can push the total into the double digits in cities like San Francisco or Los Angeles. What many fail to realize is that tax isn’t a flat figure—it hinges on product type, use case, and supplier status.

That’s where the California Sales Tax Calculator becomes essential: it dynamically applies the right rate based on your specific transaction, eliminating guesswork and manual math.

At its core, the calculator automatically identifies the correct rate by analyzing product classifications, which are rigorously defined by the California Revenue and Taxation Code. For instance, fresh groceries, prescription medications, and children’s clothing typically fall under reduced or zero tax brackets, while most electronics and household items face standard 7.25% tax.

“The statesman’s rule applies here,” observes tax compliance expert Dr. Elena Martinez. “Tax rates are not arbitrary—they reflect policy, local needs, and equitable revenue collection.”

Key Features of the California Sales Tax Calculator:

- Real-time Rate Lookup: Instantly inputs a product code or base amount to fetch the exact tax due, including local surcharges.

- Sizeable Coverage: Pre-loaded with current rates across 382 California cities, counties, and special taxing districts—no more researching rates city by city.

- Exemption Filtering: Accounts for tax-exempt transactions, critical for wholesale buyers or qualifying nonprofit purchases.

- Multi-Currency & Unit Support: Handles conversions and tax calculations for online sales, subscriptions, and bulk orders in dollars, euros, or other supported currencies.

- Downloadable Reports: Generate auditable records for compliance, tax filings, and internal accounting—ideal for auditors and bookkeepers.

The calculator’s algorithms are engineered to reflect the latest legislative updates, ensuring accuracy even as tax laws evolve. For example, recent voter-approved initiatives adjusting funding for transportation and public safety have modified tax pools, altering local rates in key urban centers.

The tool integrates these changes instantly, so users never rely on outdated rates.

Though the underlying mechanics are automated, mastering the tool requires understanding tax classifications and eligibility rules. For instance, a furniture retailer must verify whether furniture qualifies for the 2.5% threshold-exempt status or full 7.25% rate, based on price and use.

“This is where the calculator shines,” says financial consultant James Liu. “It doesn’t just spit out a number—it guides you through the logic so you validate every step.”

The calculator serves a dual role: for businesses, it reduces compliance risk and strengthens cash flow predictability; for consumers, it offers transparency, showing exactly how much tax is included in a total price. A family buying a $2,000 gaming console in Sacramento might see the tax breakfall: 7.25% state rate plus 1.750% city surcharge, totaling 8.975%—not just 7.25% as advertised.

This precision prevents shock at checkout and builds trust in price transparency.

Real-world application reveals the tool’s versatility. A small online boutique selling handmade goods across California changed operations after adopting the calculator.

“Previously, we averaged a 10% error rate in tax collection,” shared owner Priya Kapoor. “Now, every item auto-adjusts to the right rate—local, district, even temporary holiday surcharges. It’s reduced disputes, improved customer satisfaction, and eliminated overpayments.”

Best Practices for Using the California Sales Tax Calculator:

- Always classify products accurately before inputting—check the DTFA’s official business tax exemption form (SF86) when dealing with wholesale or tax-exempt scenarios.

- Use the multi-currency mode for international transactions to avoid discrepancies in reported tax liability.

- Save or screenshot tax breakdowns for audit trails, especially for business filings.

- Recheck calculations before finalizing purchase or reporting to catch edge cases like bundled discounts affecting taxable components.

- Stay updated on local rate changes via the DTFA website; while the calculator auto-updates, manual verification for new districts or special authorities adds a layer of security.

While the California Sales Tax Calculator eliminates complexity, it should complement—not replace—professional tax advice. Complex sales structures, such as franchise fees, bulk commodity exchanges, or interstate transactions, may require legal interpretation.

Yet for day-to-day purchasing and small business operations, the tool stands as an indispensable ally.

In a state where tax rates shift subtly but frequently, and regulations grow more nuanced, relying on a tool built on real legislation ensures accuracy over approximation. The California Sales Tax Calculator doesn’t just compute numbers—it empowers users to act with confidence, knowing tax liability is determined by verified data, not guesswork.

For anyone navigating California’s sales tax landscape, mastering this calculator is not optional—it’s essential.

Related Post

Calculate California Sales Tax Without a Tremble: Master the Calculator to Simplify Every Dime

Chris Stapleton Trump: The Unexpected Crossroads of Country Pop and Political Fire

South Florida Football: Your Guide To The Gridiron Powerhouse

Was Jovita Moore Married Did She Have a Husband or Kids