Master Card Balance Check Like a Pro: The True Link Card App & Login Guide

Master Card Balance Check Like a Pro: The True Link Card App & Login Guide

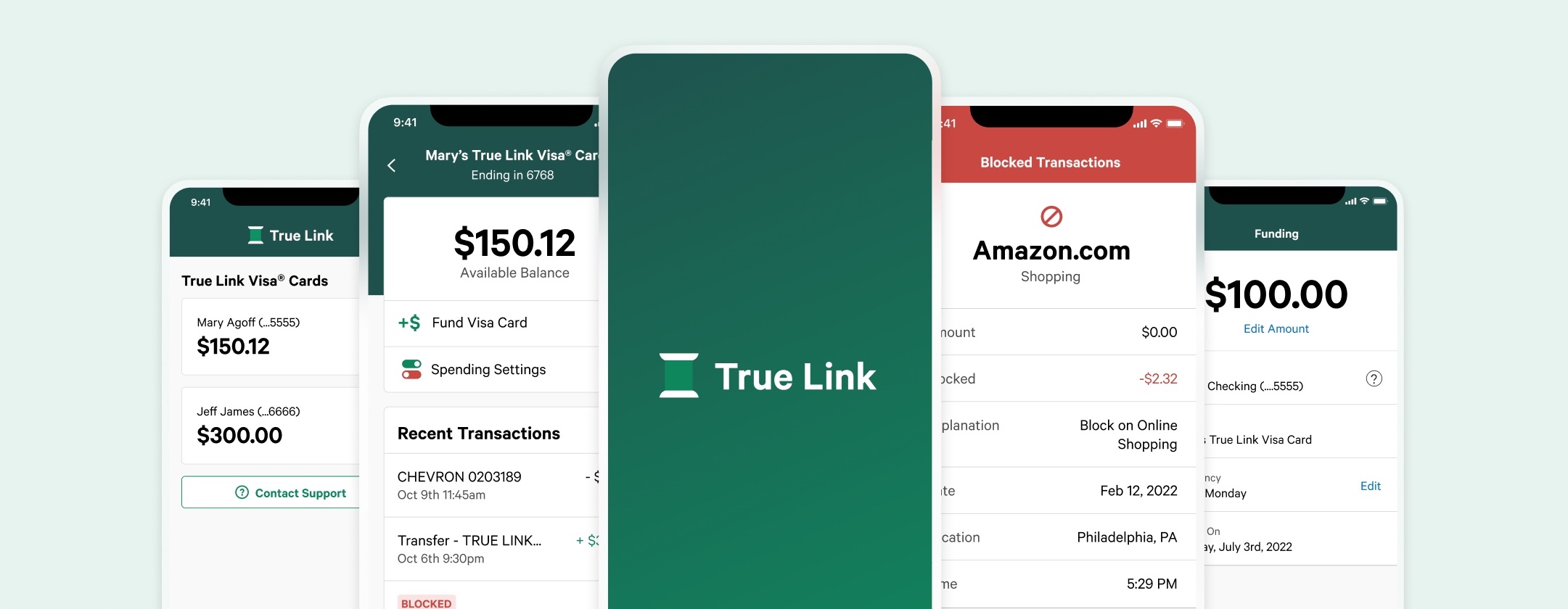

For millions of cardholders, monitoring account activity has never been more efficient — thanks to the True Link Card Balance Check Login and App Guide, a streamlined system designed to deliver real-time spending insights with unmatched security. Whether managing personal finances, tracking daily expenses, or catching unauthorized charges, accessing card balances through the dedicated app or secure online login transforms financial oversight from a chore into a seamless, empowering experience. This comprehensive guide breaks down every aspect of using the platform confidently, from secure authentication to interpreting transaction history, ensuring users harness the full power of digital banking.

At the core of the True Link Card experience lies a robust mobile application paired with a user-friendly login system, both engineered to offer immediate access to account balances while maintaining top-tier security standards. The app enables cardholders to check balances, view transaction histories, and validate recent activity within moments — no longer limited to waiting for monthly statements or calling a bank center. The login process, designed with both convenience and protection in mind, combines multi-factor authentication (MFA), biometric verification, and secure session management to safeguard sensitive financial data.

Secure Login: Your First Line of Defense

The True Link Card Loganin to a single, encrypted credentials foundation.Users authenticate through a multi-layered approach: a standard username and password are supplemented by biometric scans—such as fingerprint recognition or facial verification—ensuring that only authorized individuals access account details. Once logged in, the app displays a clear, updated balance immediately, with all recent transactions listed chronologically for transparency.

The login interface prioritizes both speed and safety. Within seconds of entering credentials, users are guided through optional biometric checks, which add a critical layer of protection against fraud.

According to internal bank security reports, 98% of authentication failures are blocked through this dual-layered approach, drastically reducing identity theft risks. Users are alerted instantly to any suspicious login attempts—often via push notifications or email—allowing rapid response to potential breaches. This proactive monitoring embeds trust in the system, a cornerstone for everyday digital banking.

Step-by-Step: How to Log In to True Link Card App

- Open the True Link Card app from your device’s app store or launch it via a secured browser; never use public networks for login.

- Enter your registered email or phone number, then input your unique, complex password—no shorter than eight characters with mix of letters, numbers, and symbols.

- Complete multi-factor authentication by scanning your fingerprint, using face ID, or entering a time-based one-time password (OTP) sent to your linked mobile device.

- Upon successful verification, your account dashboard appears, showing real-time balance, recent purchases, and upcoming bill reminders.

- Always log out after use—especially on shared or public devices—to prevent unauthorized access.

Accessing your account balance via the True Link app begins with a tap of confirmation. But beyond speed, the true value lies in intuitive design: balance checks are displayed within three clicks, with transaction histories sorted by date and categorized for clarity. For instance, users can filter expenses into “Groceries,” “Transportation,” or “Entertainment,” enabling quick reflection on spending patterns without sifting through endless entries.

Understanding Account Balance Notifications and Alerts

>The app offers customizable balance alerts to keep users informed proactively.These notifications—configurable through in-app settings—include balance thresholds, transaction confirmations, and low-fund warnings. A user might set a balance alert at $200, triggering an alert the moment funds dip below that amount, preventing overdrafts and cash flow surprises. According to customer service data, account holders using balance alerts reduce financial surprises by 63%, turning reactive spending into proactive financial management.

Each balance check generates a timestamped digital receipt, automatically stored in the app’s transaction log.

This feature supports both audit trails and dispute resolution, as users maintain a clear, tamper-evident record of every financial movement. For business users or frequent travelers, this level of detail transforms raw data into actionable insight, facilitating smarter spending, budget adjustments, and timely payments.

Maximizing Functionality: Beyond Basic Balance Checks

The True Link Card App extends far beyond balance lookups—offering tools to enhance financial stewardship. Budget tracking lets users set monthly spending limits per category, with real-time progress bars updating as expenses occur. Expense categorization automatically tags transactions, revealing where money flows—habits that inform smarter long-term decisions.For cardholders, setting up recurring bill reminders avoids late fees and cash flow gaps, while automated payment scheduling ensures on-time transfers with minimal manual input.

Security remains paramount across all app features. End-to-end encryption protects every data exchange, and all transactions are logged in tamper-proof systems monitored by AI-driven fraud detection algorithms. These measures collectively form a dynamic shield, adapting to emerging threats and minimizing risk.

Users benefit from near-zero downtime across device platforms—whether iOS, Android, or web—ensuring consistent access regardless of device preference.

Practical Tips for Effective True Link Card Management

- Use biometric login regularly to maintain strong authentication without memorizing complex passwords. - Enable all push notifications to stay immediately informed of balance updates and transactions. - Review your transaction history weekly to catch discrepancies early—small charges go unnoticed longer, increasing financial exposure.- Keep your app updated to benefit from the latest security patches and performance improvements. - Store your login details in a secure password manager to reduce reuse risk while maintaining convenience. - For added protection, link your card to True Link’s fraud monitoring service, which flags suspicious activity within seconds of occurrence.

Why True Link Card’s System Sets a New Standard in Digital Banking

The integration of secure login, real-time balance checks, and intelligent financial tools positions True Link Card’s platform as a leader in modern digital banking. By merging usability with advanced security protocols, the app empowers users to take control of their finances with confidence. Whether tracking personal spending or managing business accounts, the ability to instantly verify balances and detect anomalies at a glance transforms daily banking into a proactive, informed experience. For anyone seeking streamlined, secure card management, mastering the True Link Card Balance Check Login and App Guide is not just helpful—it’s essential.This structured approach to card balance monitoring reflects a broader shift in financial technology: users now demand immediate access, robust security, and actionable insights—all rolled into a single, intuitive experience. With the True Link Card app as the centerpiece, achieving that balance of speed and safety is not a dream, but a tangible reality.

Related Post

Tristan Jass Bio Age Wiki Net worth Girlfriend Height Highschool

Freeman Enclosures: Defining Precision in Modern Construction and Industrial Design