Loft Bill Pay: The Financial Backbone of UK Maritime Trade

Loft Bill Pay: The Financial Backbone of UK Maritime Trade

In an industry defined by precision, volume, and global reach, Loft Bill Pay stands as a cornerstone transactional mechanism enabling seamless international trade within the UK’s maritime sector. Far more than a simple invoice, the Loft Bill Pay is a legally binding financial instrument that underpins tens of thousands of shipping transactions annually, ensuring the lawful transfer of goods across borders with maritime efficiency and fiscal transparency. This article uncovers the mechanics, legal standing, and indispensable role of Loft Bill Pay in safeguarding commercial integrity in international shipping.

At its core, the Loft Bill Pay is a formal document issued by a carrier—typically a charterer or freight forwarder—to a cargo owner or importer, guaranteeing payment for goods delivered on board a vessel. Unlike standard commercial invoices, Loft Bills carry prescriptive weight: they are required by customs authorities, particularly in the UK’s heterogenous import-export environment, to validate the legality and payment status of marine cargo. Originating from the Scottish shipbroking tradition, the term “loft” derives from “loft bill,” a regional reference to warehouse-based trade transactions, reflecting the document’s historical ties to bonded storage and delivery verification.

One of the defining characteristics of Loft Bill Pay is its dual function: as both a financial obligation and a legally recognized title transfer tool.

Each Loft Bill specifies critical data—cargo description, quantities, agreed values, pointed dates, and vessel details—ensuring clarity amid complex supply chains. Crucially, the bill is “payable” only upon verifiable delivery and cleared customs clearance, thereby minimizing disputes over non-delivery or undervalued goods. As one maritime lawyer noted, “The Loft Bill Pay isn’t merely payment proof—it’s proof *of valid payment* within the framework of international maritime law.”

Historical Roots and Evolution of the Loft Bill Pay System

The Loft Bill Pay system emerged in the 19th century among Scottish shipowners and merchants, evolving as a response to the growing complexity of transatlantic shipping.Its design addressed ambiguities in cargo payment and title transfer, which were common challenges in an era before digital documentation. Initially handled by hand on paper ledgers and sealed with wax, these instruments were pivotal in enabling trust between trading partners separated by seas and time zones.

Over time, the Loft Bill Pay system formalized under UK maritime regulations, codified in part by the Carriage of Goods by Sea Act (COGSA) and modern customs directives. The Shipbrokers’ Association and the UK Board of Trade further standardized practices, embedding the loft bill into the infrastructure of international freight, especially within Europe and Commonwealth trading blocs.

Today, while documentation has digitized—via platforms like e-Loft or integrated blockchain ledgers—the fundamental structure remains rooted in centuries-old principles of accountability and verification.

Legal Authority and Regulatory Framework in the UK

In the UK, the Loft Bill Pay is recognized under the Carriage of Goods by Sea Act 1992 and associated customs codes, which endow the document with statutory validity. Under Section 968 of COGSA, a loft bill is deemed evidence of an agreed transaction and payment, enforceable in commercial courts if contested. This legal enforceability contrasts with informal shipments, where payment risks escalate and resolution mechanisms weaken.Customs authorities like HM Revenue & Customs (HMRC) rely heavily on Loft Bills to validate import declarations and duties.

The system’s design aligns with stringent anti-fraud protocols: each bill must reference a specific vessel voyage, clearly mark cargo, and confirm pointing dates—dates by which payment must be settled. Failure to meet these criteria renders the bill invalid for customs clearance, effectively blocking undervalued or undelivered cargo from entering the market. As HMRC advises, “A properly issued loft bill is not optional—it’s a prerequisite for lawful import and duty settlement.”

Key Components and Best Practices in Issuing a Loft Bill Pay

Creating a valid Loft Bill Pay demands meticulous attention to detail.Core elements include: - **Vessel Information**: Name, IMO number, and flag state of the carrier - **Cargo Specifications**: Type, quantity, and classification by weight/volume - **Points of Delivery**: Docks, ports, or transfer locations linked to specific voyages - **Payment Terms**: Amount, currency, pointed date, and signatory details - **Reference Data**: Consolidated yard or warehouse identification, if applicable

To enhance efficiency and reduce errors, modern shipping firms adopt automated Loft Bill Pay systems integrated with ERP and customs platforms. These tools validate data in real time, reduce manual entry risks, and generate tamper-resistant digital records. Best practice also includes pre-shipment verification: clinicians confirm cargo details with carriers before issuing the bill, cross-checking against shipment schedules and customs forms to avoid post-delivery disputes.

Challenges and Emerging Risks in Loft Bill Pay Practices

Despite its robust framework, the Loft Bill Pay system faces evolving challenges.Digitization, while efficient, introduces cybersecurity vulnerabilities—fraudsters increasingly target digital loft bills to defraud importers and banks. Scams involving forged bills or identity spoofing have risen, prompting tighter authentication measures such as digital signatures and multi-factor verification.

Operational delays also persist, particularly when cargo is delivered at congested ports or customs checks stall document clearance.

Misstatements in cargo descriptions or quantities—deliber

Related Post

April Roomet Stylist Bio Wiki Age Son Husband And Net Worth

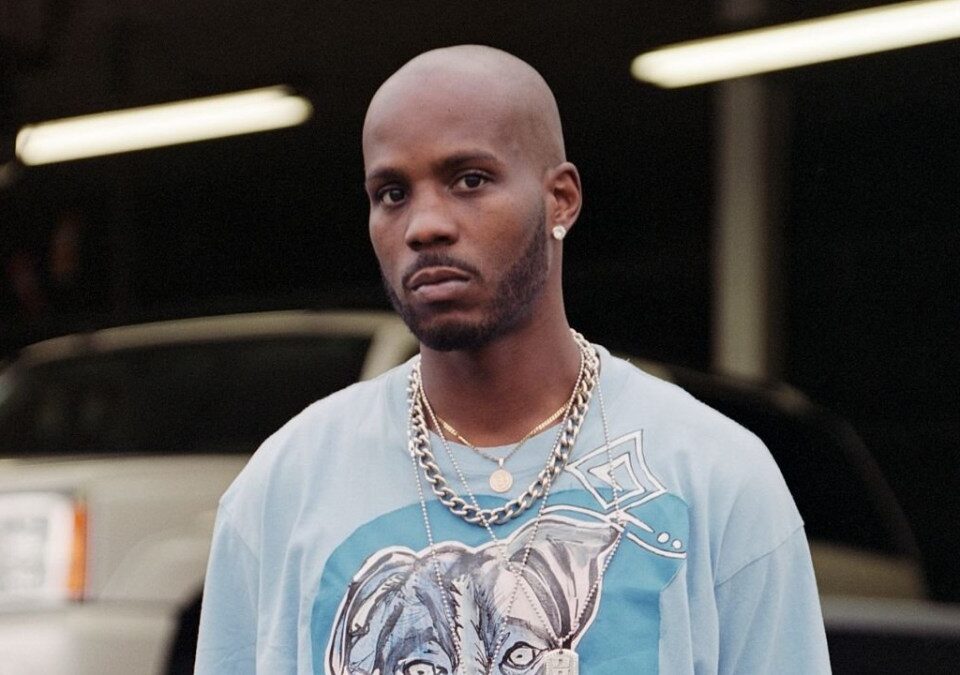

Exposing the Progression of Polo G: A Comprehensive Examination

Dorothy Bowles Ford: The Quiet Architect Behind Civic Transformation

Red Scorpions: The Silver Arrogance of the 40K Frontlines