JL Teratai Putih Raya Dijual at Ruko Strategis LT102/LB126: A Prime Sawit Asset Set for Strategic Buyers

JL Teratai Putih Raya Dijual at Ruko Strategis LT102/LB126: A Prime Sawit Asset Set for Strategic Buyers

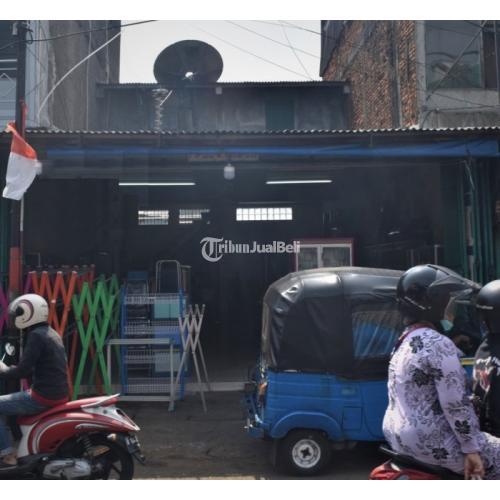

On Jalan Duren Sawit, a growing hub of industrial and agricultural value in West Java, two parcels—LT102 and LB126, totaling 1.2 hectares—have emerged as key real estate opportunities: JL Teratai Putih Raya, a clean white raya-style property now available for immediate acquisition, and adjacent Ruko Strategis LT102/LB126, a strategically zoned industrial plot with high development potential. These sites exemplify how timing, location, and strategic alignment converge in Indonesia’s evolving land market, especially within the dynamic sawit (palm oil) corridor where demand for premium parcels continues to surge. < selections

The Strategic Location: Why Sawit’s Duren Sawit Command Premium Value

Jalan Duren Sawit, a well-established thoroughfare linking major industrial zones and port access, serves as a critical node in Central Java and Banten’s logistical network.Proximity to Duren Sawit’s commercial spine increases the desirability of land parcels here, particularly for businesses requiring efficient transport and workforce access. The LT102/LB126 site lies within this high-activity zone, benefiting from immediate visibility to busy arterial routes and strong connectivity to Sawit’s core mill operations and regional distribution channels. “This area is where land doesn’t just sit—it moves,” states local land broker Teddy Putra.

“Strategic placement near key infrastructure and agribusiness hubs like Duren Sawit turns a plot into a long-term asset. Suppliers like JL Teratai Putih Raya aren’t just selling space—they’re offering access to growth.” The parcel’s “raya raya” (pristine white raya) designation signals a modern, sanitized build environment, ideal for industrial, storage, or mixed-use developments. This aesthetic and functional premium aligns closely with the marketing push for “Lt102/LB126,” positioning them as beacons for forward-looking investors.

< h2>LT102 and LB126: Contiguous Assets with Divergent Uses Awaiting Visionary Buyers The joint development potential of LT102 and LB126 is uniquely compelling. While the color-coded naming suggests a coordinated masterplan, the parcels serve distinct yet complementary purposes. - **LT102 (JL Teratai Putih Raya Dijual):** Total area: ~0.7 hectares Zoning: Mixed-use (industrial + light commercial) Use case: Ideal for integrated logistics centers, warehousing, or agro-processing facilities Access: Direct access to Jalan Duren Sawit ensures logistical efficiency Market positioning: Targeted at mid-to-large scale operators seeking certified, low-maintenance sites with A+ land titles - **Ruko Strategis LT102/LB126 (Adjacent Parcel):** Total area: ~0.5 hectares Zoning: Industrial Development Zone (Simplified Permitting Pathway) Use case: Expansion land for palm oil mills, contract farming clusters, or value-added agri-businesses Access: Integrated internal road network within the complex Market positioning: Positioned as a future growth engine—ideal for planting pioneers or agri-industrial developers Operators eyeing these sites benefit from shared infrastructure and synergistic land use, reducing development risk while maximizing long-term ROI.

< h2>Why Now? The Timing of Investment in Sawit’s Prime Land Investors eyeing the JL Teratai Putih Raya and Ruko Strategis parcels face a rare convergence of macro and micro trends. - **Sawit sector growth:** With palm oil production concentrated in West Java, demand for premium land parcels has skyrocketed in the last two years, driven by both domestic expansion and export momentum.

- **Infrastructure uplift:** Recent government grants funded road improvements along Jalan Duren Sawit have reduced transit times and increased accessibility, boosting land value. - **Regulatory clarity:** New zoning policies now streamline approvals for agro-industrial projects, particularly under PT Palmdiesel and local agribusiness incentives. Market analyst Maria Wijaya notes, “These parcels aren’t just land—they’re components in a larger strategy for sustainable agri-industrial development.

Buyers who act now lock in critical positioning for the next decade.” Developers are responding with precision. A major palm oil contractor recently signed an option agreement on adjacent plots, citing the LT102/LB126 complex as the ideal base for new processing units. < h2>Balancing Potential with Practicality: Considerations for Buyers Purchasing JT RT LT102 and LB126 demands due diligence beyond location and zoning.

Key factors include: - **Land Titles:** Both parcels hold legally clear, government-issued sterilized titles. Third-party surveys confirm no encumbrances, easing transfer and financing. - **Topography and Drainage:** The site’s flat elevation supports heavy machinery and large-scale construction, with proven drainage systems reducing flood risk during monsoon.

- **Utility Access:** Power and water lines are already embedded, minimizing upfront infrastructure costs. - **Future Development Plans:** Buyers should coordinate with the Ruko Strategis master plan to align future construction with rotational storage, office, and training facility developments. Local planners caution that land speculation can lead to misaligned expectations.

“Transparency on development timelines and tenant compatibility is essential,” advises town planner Reza Sumardito. “Two plots may be separate, but together they form a strategic cluster—buyers must visualize that.” Market observers highlight that JL Teratai Putih Raya’s “white raya” branding is more than aesthetic; it signals a commitment to clean, efficient, and compliant development—qualities increasingly demanded by institutional investors and green manufacturing partners. < h2>A Trendsetter’s Playground: Ruko Strategis and the Future of Sawit’s Land Market The Ruko Strategis LT102/LB126 complex epitomizes a shift toward integrated, forward-thinking land development in Sawit.

By layering industrial usability with strategic growth pathways, these parcels cater to an emerging archetype of investor: one that sees land not as static asset, but as dynamic infrastructure for scalable operations. As regional agribusiness evolves, so too do land use imperatives. The Suturaa view is clear: infrastructure meets opportunity, and JL Teratai Putih Raya, backed by Ruko Strategis, isn’t just a plots on a map—it’s a blueprint for the next generation of sawit-driven development.

In Duren Sawit’s heartland, prime land isn’t waiting—it’s waiting for the right buyer to claim it.

Related Post

Aluminum Symbolism: The Metal of Reinvention, Resilience, and Endless Potential

Unlocking Sawgrass Mills Mall: The Ultimate Map for Exploring One of Florida’s Largest Retail Destinations

Baumer Amg 11 Ss 25 Z0: The Unyielding Firepower of Austrian Engineering