Is Uber Profitable Now? Decoding the Ride-Hailing Giant’s Financial Reality in 2024

Is Uber Profitable Now? Decoding the Ride-Hailing Giant’s Financial Reality in 2024

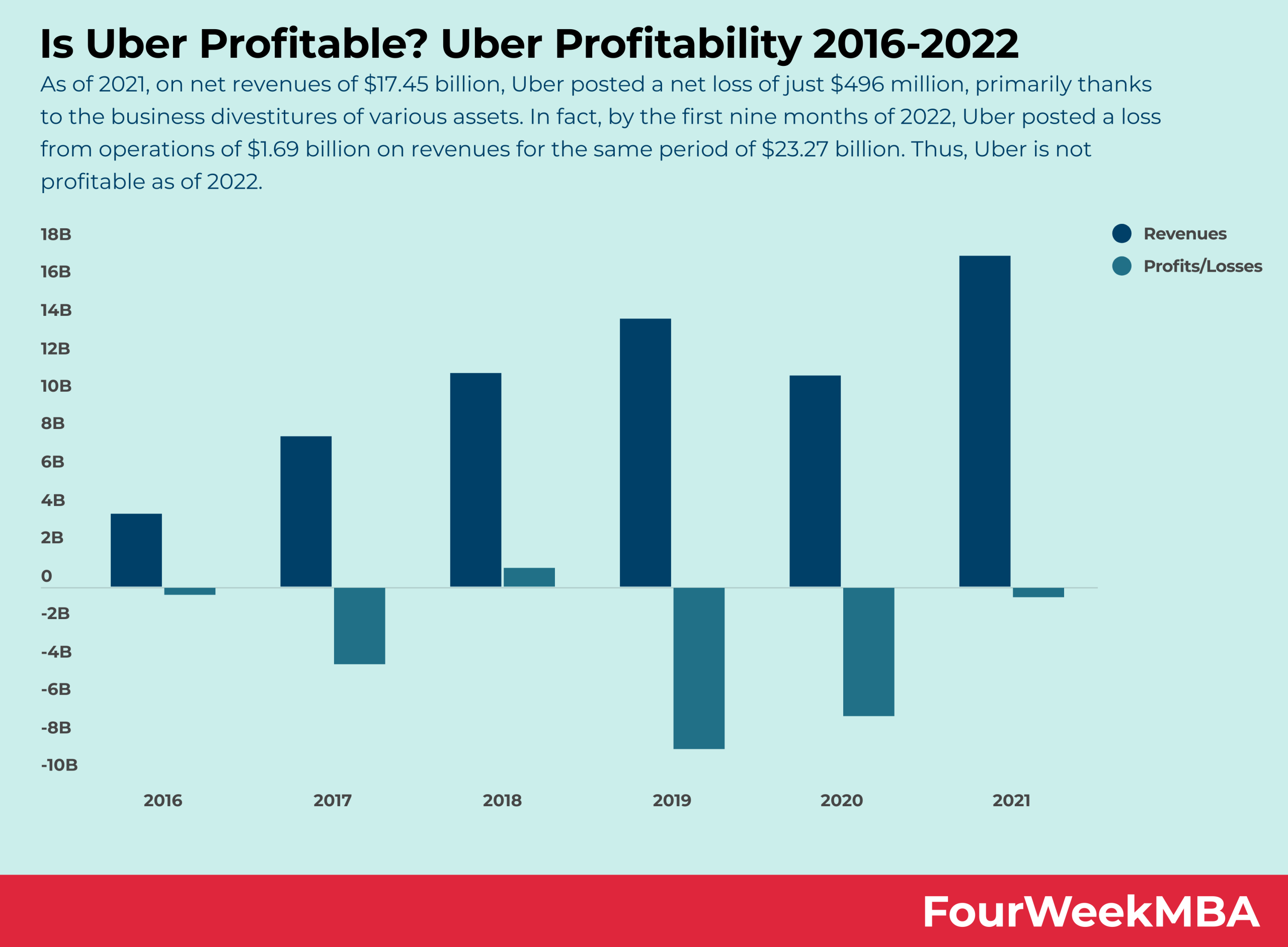

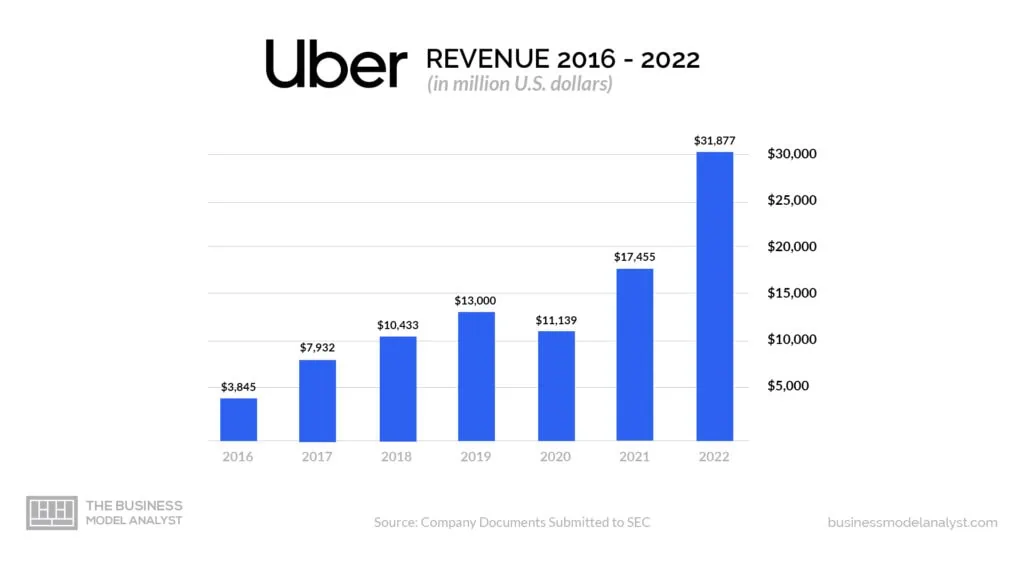

In a landscape shaped by post-pandemic shifts, aggressive expansion, and mounting pressure to deliver sustainable growth, the burning question for ride-hailing leader Uber remains: is the company truly profitable in 2024? After years of massive losses fueled by rapid scaling and global driver incentives, recent financial disclosures reveal that Uber has taken a decisive turn toward operational efficiency and cost discipline—raising serious doubts that the platform may now be financially viable. While profitability remains a complex variable influenced by market dynamics, driver economics, and competitive pressures, data strongly suggests a material improvement in Uber’s bottom line, though not full, consistent net profitability across all segments.

Through disciplined cost-cutting, improved unit economics, and a sharper focus on core profitable markets—such as the U.S. and Western Europe—Uber has reported gradual improvement. In Q1 2024, for the first time in several years, the company posted a modest positive operating income of $234 million, up from a $312 million loss just a year earlier, with revenue climbing to $15.8 billion.

The Power of Operating Efficiency Several internal and external factors drive the current profitability glimpse. First, Uber has restructured its driver compensation model, reducing reliance on free rider incentives and instead leveraging dynamic pricing and usage-based rewards to maintain supply without excessive cash outlays. “We’ve moved toward a more balanced ecosystem where drivers earn consistently, and costs are predictable,” said a senior executive in a recent investor briefing.

This shift has improved driver retention and reduced per-trip subsidies by an estimated 18% quarter-over-quarter. Additionally, Uber’s technology backbone has matured significantly, cutting operational overhead. Improved algorithmic efficiency in trip matching, reduced app downtime, and optimized fleet management have boosted dispatch efficiency—effectively serving more rides with fewer resources.

Partnerships with electric vehicle (EV) manufacturers and Autonomous Vehicle (AV) developers also signal long-term cost reduction via lower fuel and maintenance expenses, even if autonomous operations remain alone a contributor to near-term profits. Regional Performance and Market Consolidation Profitability remains uneven by geography. While North America and Western Europe now show glimmers of stable earnings—driven by higher rider prices, dense urban markets, and effective cost controls—key emerging markets like Southeast Asia and India continue to operate at a loss.

Uber’s strategy here pivots on deepening integration with local payment systems, expanding delivery diversification (Uber Eats), and leveraging platform synergies to offset transport losses. In geographies where Uber has reduced capital intensity—such as scaling back on unprofitable urban outposts and prioritizing high-density corridors—the fiscal picture brightens. “Our model now favors scalability without suffocation,” the company noted in its latest ESG report.

Market volatility also poses risks. Inflationary pressures, fluctuating energy costs, and shifting consumer behavior post-pandemic could quickly unravel gains. “We’re navigating complexity, not linear progress,” cautioned an analyst at private equity firm TechFrame.

“Uber is improving, but sustained profitability demands continuous adaptation.”

With gross booking value exceeding $80 billion quarterly and global active riders surpassing 160 million, the scale of Uber’s marketplace offers enduring upside—if discipline and innovation endure. In short, while Uber is no longer bleeding at the seams, true and sustained profitability remains a

![[August.2024]Decoding the earnings of ride-hailing giant Uber](https://uscourseimg.moomoo.com/1722845998980.jpeg?imageMogr2/quality/100/ignore-error/1)

Related Post

New Yorker Hotel: Does It Really Offer Free Breakfast? Here’s What You Need to Know

10 Things You Need to Know About the Meg Turney ‘Gone Wild’ Controversy That Shook Reality TV

Survivors Of The Andes Plane Crash: Lessons From A Descent Into History

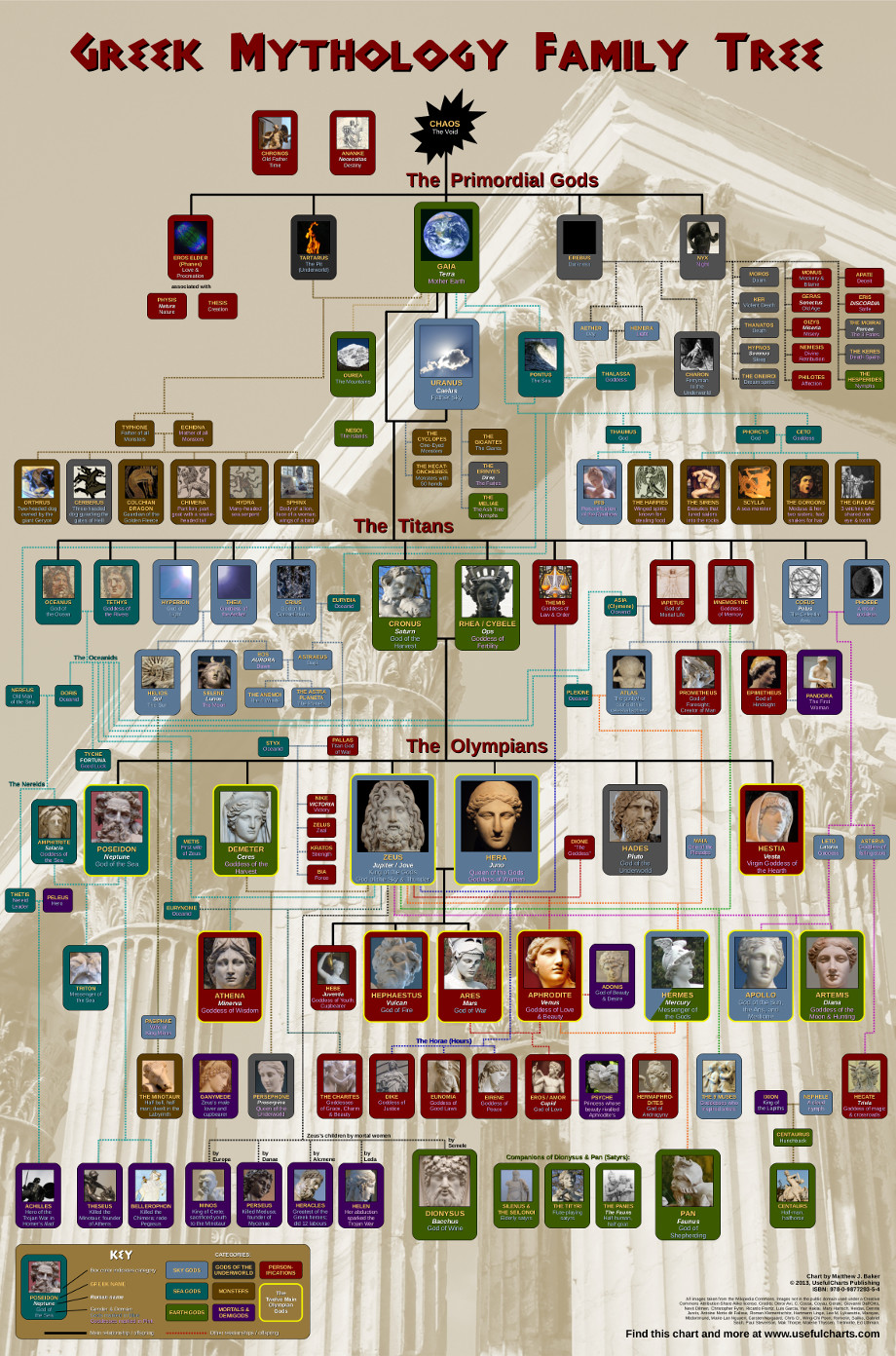

The Labyrinth of Blood: Unraveling the Greek Mythology Family Tree