Intel Stock Price Prediction What’s In Store: Insights on Tech’s Flagship Stock in 2025

Intel Stock Price Prediction What’s In Store: Insights on Tech’s Flagship Stock in 2025

Market watchers continue to scrutinize Intel Corporation’s stock—ranging from institutional analysts to retail investors—seeking clarity amid turbulent semiconductor cycles, shifting supply dynamics, and aggressive strategic pivots. As Intel navigates its ambitious transformation under new leadership, forecasts for its share price reflect both cautious optimism and persistent skepticism. The coming year, forecasters suggest, will reveal whether Intel can successfully reclaim its position as a dominant force in chips, data centers, and AI-driven innovation.

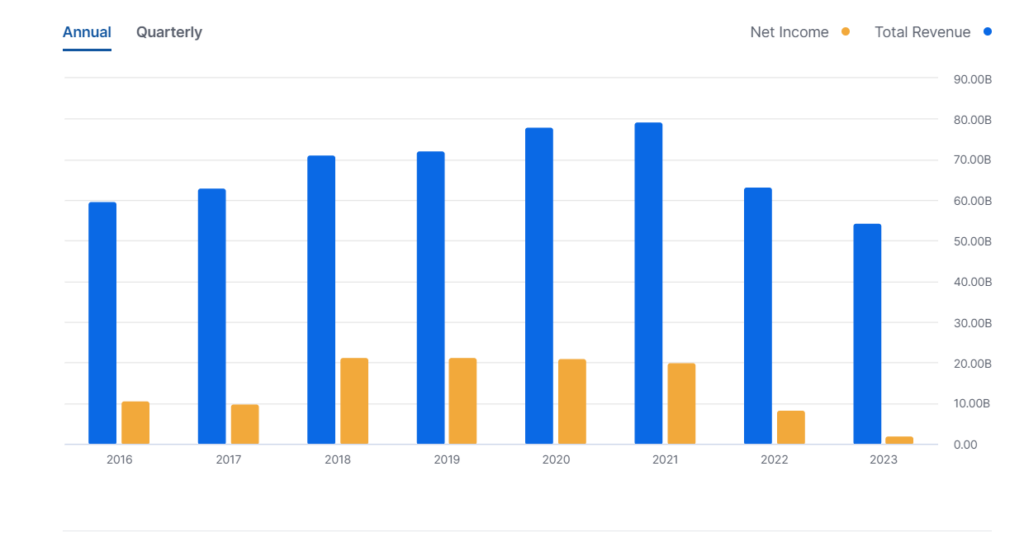

Intel’s stock, historically a bellwether for U.S. tech leadership, has seen marked volatility in recent years. Prices hovered around $20 in 2022 but rebounded to over $30 by early 2024 after a multi-year correction.

As of mid-2025, shares trade near $34—a level analysts cite as a critical inflection point tied to execution on IDM 2.0, AI chip development, and stock performance amid rising sector competition.

What Drives Intel’s Stock Price Forecast? Core Catalysts and Headwinds

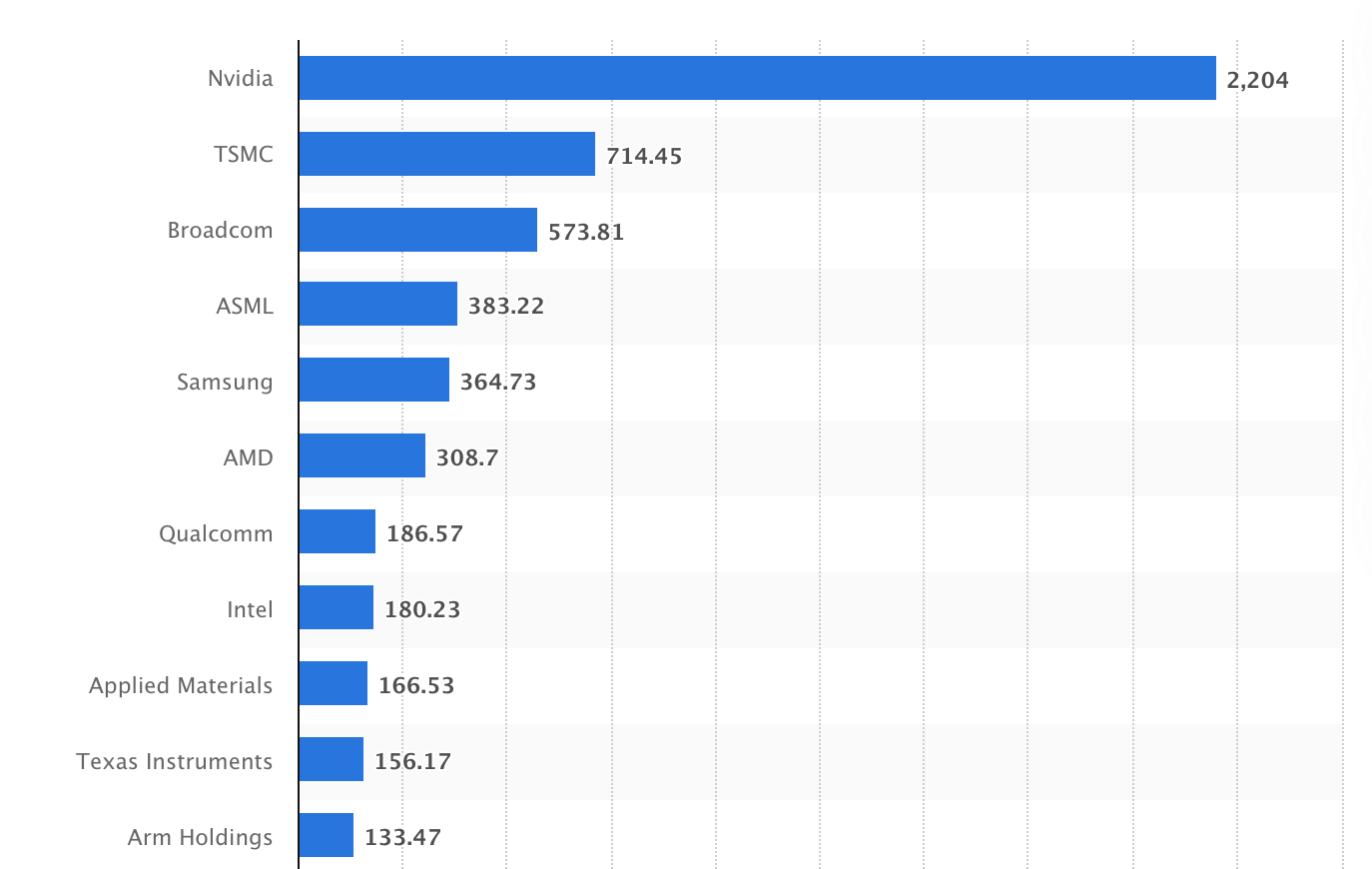

Several key factors shape modern predictions for Intel’s stock trajectory. Industry analysts focus on four primary drivers: - **IDM 2.0 Transformation**: Intel’s $20 billion capital expenditure plan to expand foundry capacity and ramp advanced process nodes directly impacts long-term valuation.Completion of new fabs in Arizona and Ohio, coupled with improved yield rates, is seen as vital to regaining market share. - **AI and Data Center Momentum**: With growing demand for on-premises AI inference and edge computing, Intel’s emerging GAA (Gate-All-Around) transistor technology and Ponte Vecchio GPUs position it to compete with TSMC and NVIDIA. - **Competitive Pressure**: Aggressive pricing and innovation from AMD, Samsung, and TSMC challenge Intel’s traditional CPU stronghold.

Market participants demand concrete delivery timelines to validate shift expectations. - **Cash Flow and Profitability**: Restructuring costs and reinvestment in next-gen manufacturing affect near-term earnings. Gross margins rebounded to ~47% in Q2 2025, signaling improved cost control but long-term profitability remains under scrutiny.

“Intel’s ability to monetize its foundry ambitions while delivering superior process tech is the single biggest variable,” noted Sarah Chen, senior technology analyst at Fidelity Investments. “The rest is execution—and timing.”

Expert Forecasts: Range and Realism in Stock Price Predictions

Different analysts offer varied yet grounded views on Intel’s 2025 outlook. According to a recent survey by Bloomberg Intelligence, median long-term price targets hover around $48–$52 per share, reflecting confidence in operational improvements but guarded caution on near-term reflation.Breakdown of expert consensus: - **Bullish Scenario**: Bull market analysts at Goldman Sachs project a potential $55 ceiling by year-end using a base case of stable foundry wins and a 12% GAAP earnings growth, supported by successful PCIe 5.0 and Sapphire Rapids data center adoption. - **Neutral Outlook**: Mid-range models suggest $44–$47, consistent with Morgan Stanley’s assessment that while Intel’s strategic bets are sound, macroeconomic headwinds and execution risks—particularly in overseas facility rollouts—limit upside potential. - **Bear Caution**: Some developers at JPMorgan warn of “value trap” risks, citing lingering doubts over Intel’s ability to scale advanced nodes and defeat TSMC’s cost leadership.

They rate current positioning “sideways” with a target of $38, warning aggressive shares should prepare for volatility.

Analysts frequently highlight stock volatility linked to Intel’s quarterly updates. When Intel reported mixed 2025 Q1 results—tempered growth in discrete GPU sales offset by foundry order wins— shares retreated sharply, underscoring market sensitivity to momentum.

Technical Indicators and Chart Signals: Is Intel Next a Reconversion Catalyst?

Technical analysts tracking Intel’s shares (NASDAQ: INTC) emphasize recent stock behavior.The stock has maintained a strong upper trendline above $33 since Q4 2024, supported by an expanding moving average. Key technical levels to watch include: - **50-Day Moving Average**: Stable near $35; a sustained break below signals sharp caution. - **Volume Spikes**: Recent rallies coincided with strong order backlogs—confirming bullish conviction.

- **Resistance at $42**: A critical zone where resistance levels may test support in coming months. “The current support between $34–$35 acts as a buffer,” explained Mark Reynolds, senior market strategist at TD Securities. “Should prices hold this range through Q3, the stage is set for a meaningful breakout—or a correction—depending on news flow.”

Fundamentally, Intel’s stock valuation remains intrinsically tied to its ability to execute its IDM 2.0 roadmap.

Investors monitor leading-edge product wins like the Arrow Lake CPUs and Rapidiana processor software, as well as foundry contracts with DoD and private cloud clients. The interplay between innovation velocity, global supply chain stability, and competitive pricing will ultimately determine whether Intel returns to its former valuation peak or settles into a new era defined by transformation rather than dominance.

The coming 12 months are pivotal: Intel’s stock prediction WHAT

Related Post

Sone 385 Explained: Everything You Need to Know About This Technological Marvel

Chuck Norris Find: The Unstoppable Force Behind the Legend

Paco Rabanne Invictus: The Sport Fragrance Redefining Urban Edge with Cost & Cult Appeal

Chris Powell Workout Bio Wiki Age Wife Website And Net Worth