IDeposite ATM Turns Cash Deposits into Hassle-Free Transactions

IDeposite ATM Turns Cash Deposits into Hassle-Free Transactions

For anyone who’s ever stood around a bank teller, counting stacks of cash or juggling receipts, the ritual of depositing money at an ATM feels more like a chore than a seamless financial action. But with IDeposite ATM, that once-stressful routine has been redefined—delivering fast, secure, and transparent cash deposits with minimal friction. By leveraging advanced technology and intuitive design, IDeposite reimagines the deposit process, making financial transactions efficient for modern life.

At the core of IDeposite’s innovation is its straightforward, user-first approach. Unlike traditional bank ATMs that often demand paperwork, limited daily limits, or time-consuming verification, the IDeposite system enables cash deposits through a standalone or integrated terminal accessible at numerous partner locations—from major banking hubs to remote regional centers. Depositors place cash directly into a secure, tamper-resistant slot equipped with high-resolution imaging and weight verification, while built-in fraud-detection software instantly analyzes transaction patterns and alerts potential risks in real time.

This combination of speed and security transforms cash handling from a source of anxiety into a predictable, trustworthy process.

How IDeposite Streamlines the Cash Deposit Experience

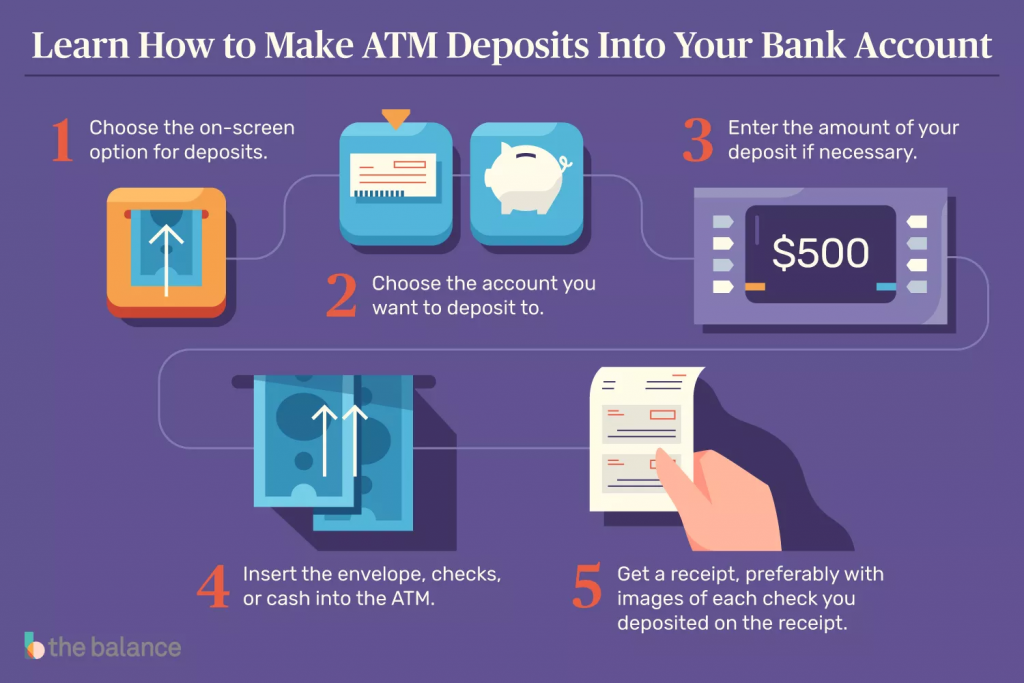

The operational model behind IDeposite ATM reflects a deliberate shift toward convenience. Each deposit follows a structured, self-guided flow that minimizes interaction with human staff, reducing wait times and administrative bottlenecks. Key steps include: - **Balance Check & Authorization**: Users first verify their account balance via the ATM interface, often syncing directly with connected banking apps.- **Cash Handling**: Cash is deposited via a dedicated chute with automatic count verification—ensuring accuracy down to the penny. - **Validation & Encryption**: Every deposit triggers real-time data encryption and biometric or PIN-based identity checks, reinforcing security. - **Receipt & Confirmation**: Users receive an immediate digital receipt with deposit details and a unique transaction ID for audit purposes.

“This system removes guesswork,” said a financial technology analyst. “Depositors know exactly what to expect: clear instructions, minimal steps, and instant validation—everything a busy professional needs in today’s fast-paced world.”

The ATM’s design also supports legacy device compatibility, allowing banks with differing infrastructure to adopt IDeposite without costly overhauls. This scalability has accelerated adoption across regions, with thousands of ATMs now operational under partnerships with retail chains, post offices, and private financial networks.

Daily deposit limits typically range from $500 to $5,000, structured to cover everyday needs—from salary receipts to event payments—while remaining compliant with industry anti-money laundering (AML) standards.

Seamless Integration with Modern Financial Habits

Cash, though increasingly digital, remains essential for many transactions—whether at family gatherings, informal economies, or in areas with limited internet access. IDeposite bridges the physical and digital divide by embedding smart access controls into its hardware. Biometric authentication, such as fingerprint scanning or facial recognition, adds a layer of personal security while eliminating the need for physical cards or paper IDs each time—a feature particularly appreciated by frequent users.For smaller businesses, IDeposite ATMs offer dual benefits: external cash management without exposing internal accounting systems, and streamlined reconciliation through standardized deposit logs. Employees no longer waste time managing overflowing cash drawers or verifying loose change—freeing resources for core operations.

The system’s analytics dashboard provides real-time insights into deposit volumes, common transaction times, and potential anomalies, empowering businesses and banks to optimize staffing, equipment deployment, and fraud response strategies. This data-driven transparency enhances not just convenience, but operational intelligence.

Security at the Core: Built-In Safeguards

Security is non-negotiable in the deposit experience, and IDeposite excels in this domain.Multiple layers protect both users and institutions: - **Tamper-Resistant Verification Chutes**: Cash enters a protected slot sealed upon insertion, preventing counterfeiting attempts before verification. - **AI-Powered Surveillance**: Continuous video monitoring, paired with anomaly detection algorithms, identifies suspicious activity—ranging from unusual deposit volumes to

Related Post

Mike Brewer Wheeler Dealers Bio Wiki Age Wife Salary and Net Worth