How to Pay Your Capital One Auto Loan with Ease and Control

How to Pay Your Capital One Auto Loan with Ease and Control

Navigating the journey of financing a new vehicle through a Capital One auto loan doesn’t have to be complicated. Whether you’re starting fresh with a first-time loan or refinancing an existing agreement, understanding the full lifecycle of payment is key to maintaining financial health and avoiding unnecessary stress. From setting up automated payments to exploring early repayment strategies, paying your Capital One auto loan efficiently empowers you with control, saves money, and keeps your credit standing strong.

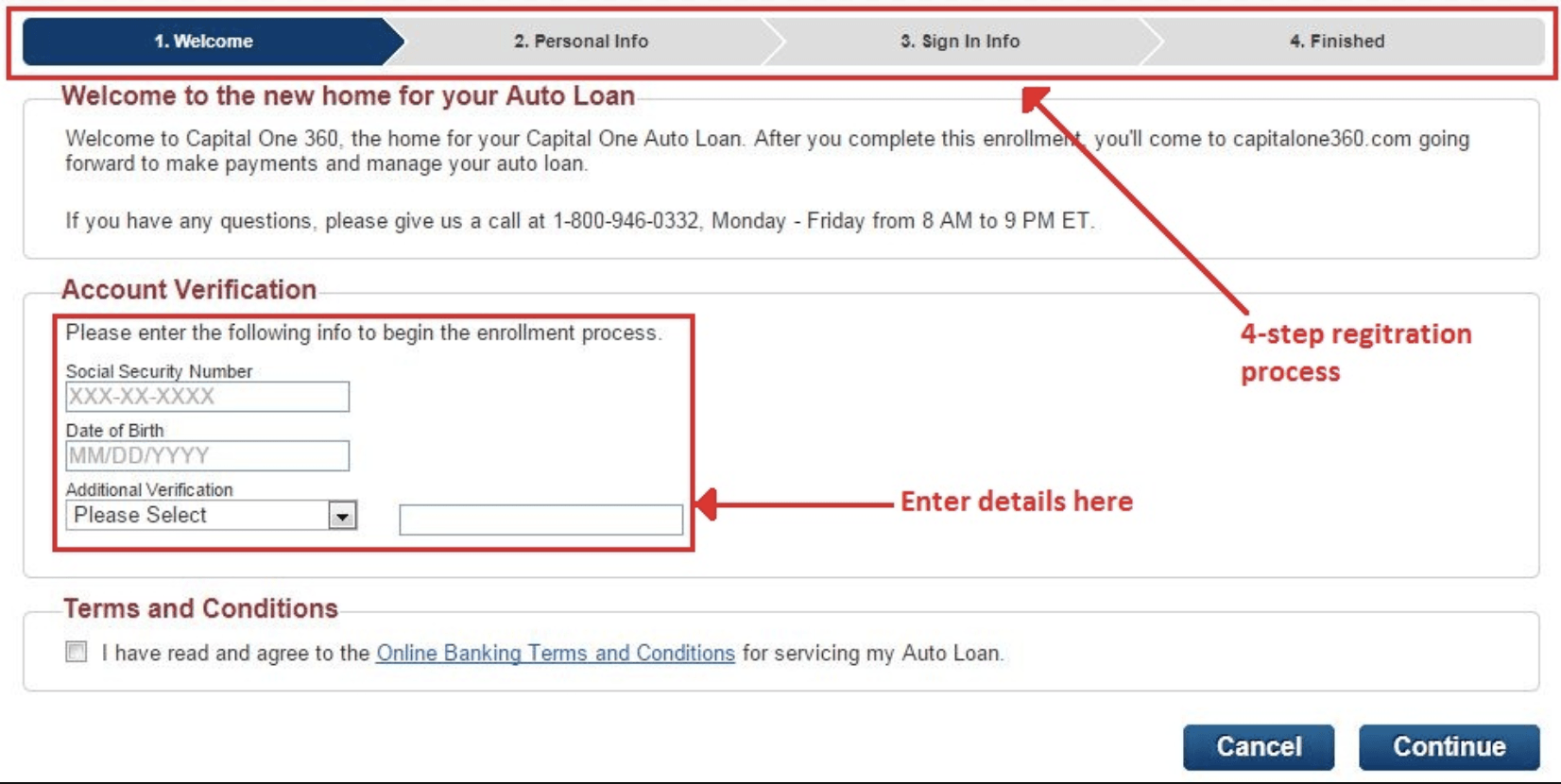

This comprehensive guide illuminates the most effective methods to manage your auto loan repayment with confidence, clarity, and cost-effectiveness. ### Choosing Your Payment Method That Fits Your Lifestyle Capital One offers flexible repayment options designed to suit clients’ unique financial habits. Among the simplest tools is automatic payment—enrolled through the Capital One mobile app or online banking portal.

Setting up auto-debit ensures on-time payments, eliminates late fees, and often qualifies borrowers for small rebates or interest rate perks. According to Capital One’s official information, “Automatic payments help you stay on track and demonstrate consistent responsibility, which can positively influence your credit profile over time.” For those who prefer manual handling, managing payments via check or bank transfer remains fully available. Platforms like direct deposit align seamlessly with payroll cycles, reducing the risk of missed due dates.

Many borrowers also find integrating their Capital One auto loan payment with existing checking or savings accounts creates a streamlined financial routine, improving cash flow management and minimizing administrative overhead. ### Mastering Digital Tools for Effortless Bill Payment Capital One has positioned itself at the forefront of digital banking innovation, making loan repayments more accessible than ever. Through the Capital One mobile app, users can schedule payments, view balances, and receive real-time transaction alerts—all within minutes.

Auto-scheduling payments a few days before the due date is strongly recommended to allow processing time and prevent payment delays. The app also supports one-tap payment options and recurring deposit features that integrate with financial planning tools. A standout feature is the live fund availability indicator, which prevents overdraft risks by showing exact remaining balances each time a payment is pushed.

For tech-savvy users, enabling notifications via SMS or email ensures no payment slip goes unnoticed, reinforcing a habit of disciplined loan management. ### Understanding Payment Schedules and Due Dates Successfully paying a Capital One auto loan hinges on precise understanding of due dates and payment frequency. Loan terms typically involve monthly installments, though annual or semi-annual plans may be available upon request during application or repayment adjustments.

Each payment due aligns with standard banking cycles—usually the 15th or 20th of the month—depending on your prepayment schedule. Capital One’s repayment calendar is integrated into the loan servicing dashboard, clearly outlining due dates across the loan term. Missing a payment triggers not only story fees but may activate a grace period and, in severe cases, interest rate hikes or credit score penalties.

Borrowers are advised to settle at least $50–$100 more than the minimum to cover processing and prevent late fees, a small buffer that preserves positive compliance history. ### Managing Payment Method Risks and Safeguarding Your Loan While Capital One provides robust payment infrastructure, proactive measures reduce vulnerability and unintended derails. Setting up warning alerts for upcoming due dates acts as a financial safety net, particularly during seasonal income fluctuations or unexpected expenses.

For those utilizing external payment platforms, verifying direct deposit reliability prevents fund timing mismatches that could breach payment terms. Transparency in payment routing is essential. Loans served through Capital One primarily process payments via ACH, but individuals applying for alternative servicers or coordinating with third-party aggregators should confirm that all payments revert directly to the principal and interest owed under the original loan agreement.

Discrepancies in payment linkage risk inflated interest charges or delayed principal reduction, undermining financial discipline. ### Leveraging Early Repayment to Save Money and Accelerate Ownership Paying more than the minimum monthly payment significantly reduces total interest costs and shortens loan duration. Capital One’s loan documents confirm that even partial prepayments accelerate principal reduction—typically cutting payback time by several months, depending on the original term.

Users benefit from clear repayment calculators hosted on the Capital One website, enabling precise modeling of “what-if” scenarios like accelerating payments by $50 monthly. Another powerful tactic involves reallocating episode lump sums—configuration bonuses, tax refunds, or work bonuses—directly toward the loan balance. Such targeted actions reduce borrowed principal rapidly, lowering long-term interest outlays without altering payment frequency.

This strategy underscores how minor shifts in repayment behavior generate substantial financial advantages over time. ### Amending Payment Terms and Communicating with Capital One Timely adjustments to payment plans are both possible and advisable. Should a borrower anticipate financial strain, reducing payment amounts by using Capital One’s communication channels avoids default force majeure.

Conversely, if improved income enables earlier repayment, changing terms can be seamlessly initiated via the app or phone support. Capital One’s customer service team is trained to guide loan modifications, though fees or restructuring terms may apply—transparency in disclosure is a key principle enforced by the bank. Open dialogue ensures alignment between borrower capacity and loan obligations.

Regular review periods—often every six months—present ideal windows to reassess payment strategies, update banking preferences, and recalibrate goals, maintaining a dynamic relationship rather than a rigid obligation. ### Final Thoughts: Owning Your Auto Loan Journey Paying your Capital One auto loan effectively is about more than mere compliance—it’s a strategic exercise in financial empowerment. With automated reminders, digital tracking, and flexible scheduling, the process becomes lean, predictable, and even empowering.

By understanding payment mechanics, leveraging tools wisely, and proactively managing due dates, borrowers protect their credit, minimize interest, and maintain control over their financial future. In an era where financial simplicity defines long-term success, mastering how to pay your Capital One auto loan isn’t just transactional—it’s transformative. Take charge today, and turn loan repayment into a reliable, cost-efficient milestone on your journey to financial freedom.

Related Post

David And Rebecca Muir: Pioneers in Advancing Human Understanding Through Science and Storytelling

Riley Green’s Family at the Heart of Country Music: The Green Family Unveiled in

Joy Purdy WJXT Bio Wiki Age Family Birthday Husband Salary and Net Worth

AEW Announces Card For Rampage The First Dance