How Capital Stock Increase Works: Debit, Credit, and What Investors Need to Know

How Capital Stock Increase Works: Debit, Credit, and What Investors Need to Know

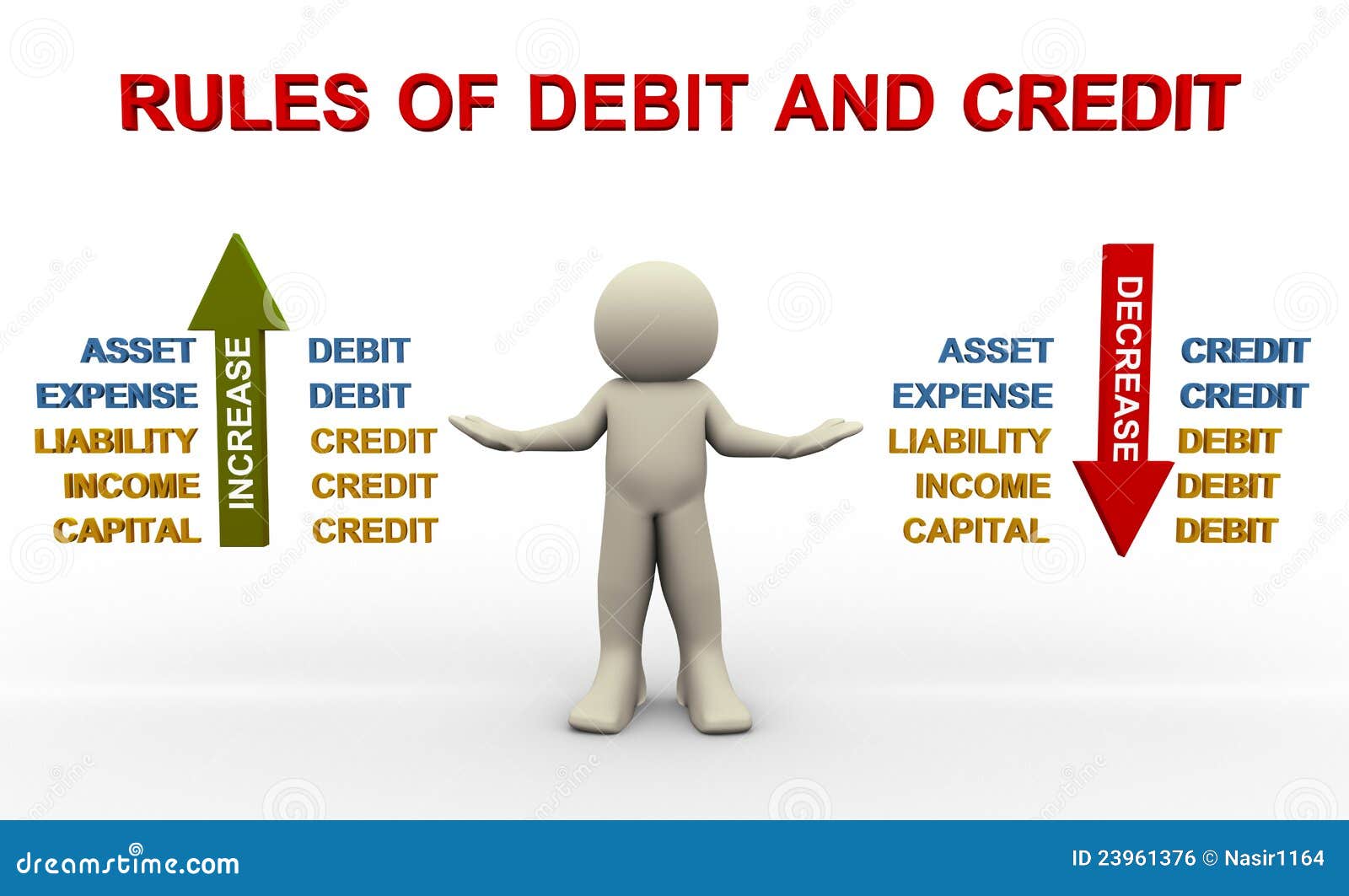

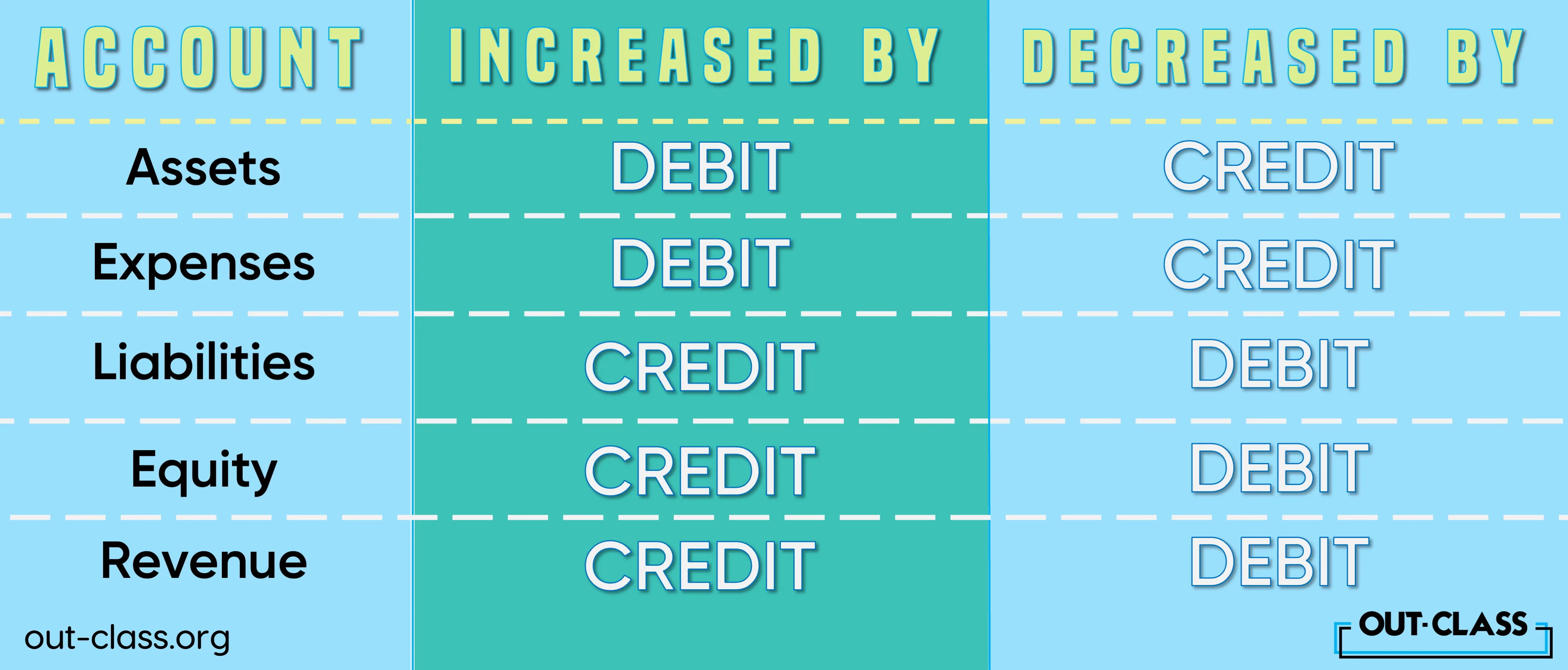

When a company boosts its capital by issuing new shares, the accounting entries reveal a precise shift in equity—gained through a debit to retained earnings via stock premium, and credited to capital stock. This fundamental move, known as a capital stock increase, alters a firm’s share structure and balances financial statements with greater clarity. Understanding whether the increase registers as a debit or credit—though often misunderstood—unlocks transparency and proper governance in corporate finance.

At its core, a capital stock increase is recorded as a debit to capital stock, credited to retained earnings, reflecting the inflow of excess capital not fully reflected in the par value of newly issued shares. Despite common confusion, the cash or currency received from new investors enters the company’s accounts as a debit, strengthening equity on the balance sheet. This debit-backed inflow supports long-term financing, signaling confidence and expanded ownership capacity.

To unpack how debits and credits shape this transformation, consider the double-entry accounting principle: every accounting action affects at least two accounts to preserve the equation Assets = Liabilities + Equity. In a capital stock increase, the influx of new equity capital is driven by proceeds from shareholders, which first strike retained earnings—a liability-equity component. This debit entry increases total equity, effectively saying the company now holds more ownership capital.

At the same time, the equivalent value recorded in retained earnings captures the premium paid over par value, boosting share capital paired with an uptick in retained earnings through the credit.

Specifically, the entry unfolds as follows: a debit to capital stock at the top reflects the raised equity base; a corresponding credit to retained earnings ensures equity remains balanced. For example, if a company issues shares valued at $5 million with a par value of $1 million and chairman’s bonus $1 million, the total capital increase of $7 million debits capital stock, crediting retained earnings by $7 million. Investors and analysts recognize this not merely as a growth metric but as evidence of strengthened balance sheet resilience.

One source emphasizes: “A stock stock increase is inherently an equity expansion; the debit to stock capital reflects investor commitment, while retained earnings absorb excess capital that exceeds par value.” This duality ensures transparency—every dollar raised through shares is accounted for, aligning with both financial reporting standards and corporate accountability.

The mechanics hinge on distinguishing between cash and non-cash contributions.

When new shares are issued and investors receive cash, that cash becomes a debit to capital stock. Conversely, if shares are issued in exchange for non-cash assets—such as machinery or intellectual property—fair value adjustments affect retained earnings differently, but the foundational principle remains: equity increases via capital stock debits and influxes of invested funds. Retained earnings absorb the earnings component tied directly to the issuing transaction, reinforcing long-term stakeholder value.

Why does this matter beyond the ledger?

A capital stock increase, properly documented, enhances investor confidence by demonstrating clear, legal, and transparent capital management. It enables future equity raises, supports acquisition funding, and signals strategic growth. Worse, misclassification—like mistakenly crediting cash instead of equity—can distort financial health and trigger regulatory scrutiny.

As financial journalist Mark Z. Jacobson notes, “Accurate accounting for stock increases isn’t just bookkeeping—it’s the backbone of market trust.”

Practical implications for corporate finance include enhanced flexibility in funding operations, expansion, and R&D through share issuance without immediate profit pressure. However, this dilutes existing ownership unless offset by growth or retained earnings accumulation.

Companies often pair stock increases with robust investor communication, explaining capital structure changes and expected future returns. Such narratives turn a technical accounting event into a strategic story, reassuring stakeholders of long-term vision.

Real-world examples underscore the impact. In 2021, Microsoft issued $14.7 billion in new shares as part of a larger equity monetization strategy.

Though small per share, the sheer volume expanded capital reserves, funded innovation, and aligned with shareholder restoration plans—all documented through precise debit/credit mechanics. Similarly, startups in venture capital rounds routinely increase capital stock through multiple trust rounds, each entry carefully logged to maintain investor clarity and compliance.

Accounting standards, including U.S. GAAP and IFRS, mandate that equity increases reflect both cash inflows and value-added shareholder investments, requiring disclosures that explain the nature and impact of each capital transaction.

This ensures full visibility into how new shares affect ownership, liability, and future profitability. Analysts rely on these records to assess a company’s capital strength and strategic agility.

Ultimately, the debate settles on a clear accounting truth: capital stock increases are recorded as debits—representing incoming capital—offset by corresponding credits to retained earnings, anchoring financial statements in integrity. This structured dual entry not only balances the books but embodies transparency, governance, and growth.

In an era where capital markets demand clarity, understanding this dynamic transforms journalistic and practical comprehension of corporate evolution.

As companies navigate fundraising, expansion, and shareholder returns, the precise treatment of capital stock increases remains indispensable. From double-entry precision to stakeholder communication, every debit and credit tells a story—of strength, vision, and trust. In the world of corporate finance, a well-documented stock increase is far more than an entry—it’s a commitment written in numbers.

Related Post

Is Francis Wang Married? Unlocking the Life Behind the Name in Tech and Music

Dodgers vs Yankees: The Historic First Clash That Ignited a Legacy of Rivalry

Unveiling The Enigma: The Life And Legacy Of Jaye Rudolph

The Square Root of -4: Decoding a Complex Irony in Mathematics