From Wallet to Checkout: How to Transfer PayPal Funds via Google Wallet

From Wallet to Checkout: How to Transfer PayPal Funds via Google Wallet

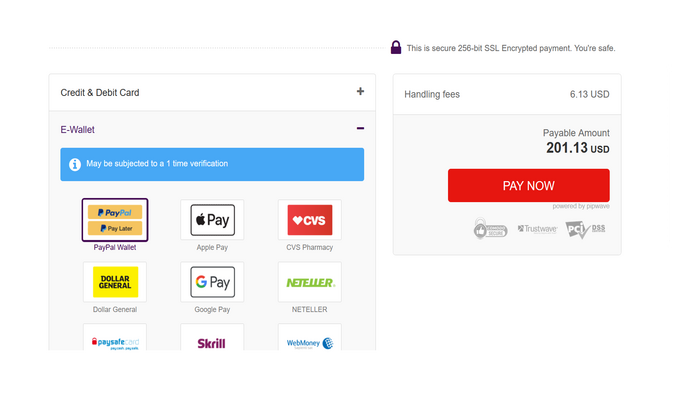

For millions of digital-native users, the friction between mobile payment tools and seamless shopping remains a daily challenge. Whether coding a microservice or simply processing a transaction at a café, the need to move money between platforms is constant. Among the most viable solutions is enabling donna transfer of funds fromGoogle Wallet directly to PayPal—bridging two powerful digital wallets in a way that feels instant and hassle-free.

This process, though not always market-facing, unlocks powerful convenience for cross-platform commerce, blending the familiarity of a trusted mobile wallet with the robustness of PayPal’s global reach.

At the core of this transfer mechanism lies the underlying interoperability protocols defined by both PayPal and Alphabet, which allow funds stored in one ecosystem to be converted and sent into another without manual intervention. Users don’t toggle between apps or worry about currency conversion delays—instead, when linking theirGoogle Wallet to PayPal, transactions initiate through secure API channels that validate balances, authenticate identity, and execute transfers in real time.

Technical Architecture of the Transfer Flow The actual transfer begins when a user authenticates access betweenGoogle Wallet and PayPal through either a confirmed payer profile or a linked fund pool. This integration leverages OAuth-based authentication and encrypted token exchanges, ensuring data privacy and transaction integrity. Once both wallets are verified, the system automatically assesses available funds within the designated wallet balance—often in USD, EUR, or GBP—and initiates a fund conversion using current market rates, if applicable.

The transferred amount is then routed via PayPal’s global payment network, with settlement times typically completing within seconds to minutes, depending on savings or checking account status in the linked peer. Unlike third-party bridges, this method operates natively within both platforms, minimizing latency and reducing fees—making it ideal for frequent, micro-level transactions.

One of the most compelling advantages is the seamless user experience: no need for manual card entries, no worrying about account limits during initial setup.

For example, a user holding $200 in digital tokens within their verified Google Wallet can instantly credit that balance to PayPal’s funds without leaving the shopping flow. Similarly, a recipient of PayPal payments received via the linked wallet receives funds in real time, reducing the typical 1–3 day processing window. This fluidity is particularly impactful for freelancers, small business owners, and cross-border commerce participants who rely on rapid, reliable fund movement.

Security and Compliance: Behind the Seamless Transfer Despite the ease of use, security remains paramount. Both Alphabet and PayPal enforce multi-layered safeguards, including two-factor authentication, end-to-end encryption, and real-time fraud detection systems. Every transfer is logged and reversible within a defined timeframe—providing a safety net against accidental errors or unauthorized activity.

Regulatory compliance further strengthens trust: the transfer adheres to AML (Anti-Money Laundering) and KYC (Know Your Customer) standards, verified through digital ID checks and transaction reporting to financial authorities. This ensures that convenience never comes at the cost of oversight. As one payments expert notes, “Modern digital wallets don’t just store money—they validate, protect, and move it with institutional-grade rigor.”

User experience design plays a crucial role in adoption.

Touching every step—from wallet selection to confirmation—requires intuitive UI that guides without overwhelming. PayPal and Goethe Wallet have collaborated to streamline this journey: Snapshot authentication replaces outdated password prompts, bio-metric access ensures immediacy, and progress indicators keep users informed during high-volume bank verification steps. For frequent shoppers, this reduces cognitive load significantly—each transaction feels like a natural extension of daily financial management rather than a complex technical hurdle.

Practical Use Cases and Real-World Impact(h2) The utility of linking these wallets manifests in diverse scenarios. Consider a freelance graphic designer earning PayPal through a U.S.-based platform but needing Euro-denominated payouts for European clients; connecting their Goethe Wallet enables direct fiat conversion and transfer with zero intermediary fees. A small business owner managing overseas orders benefits from consolidated cash flow visibility, viewing all payments in a single digital account.

Students splitting bills find split payments simpler when funds flow between mobile wallets instantly. Even in international travel, travelers leverage this link to load local PayPal-compatible funds directly from their digital wallet—avoiding foreign exchange markups or physical currency hassle. The integration transforms payment infrastructure from a theoretical tool into a tangible enabler of financial agility.

While third-party services offer bridge functionalities, native wallet-to-wallet transfers within the ecosystem maintain an edge: reduced dependency on external converters, faster settlement, and tighter integration with each platform’s broader financial features. Users rarely notice the wallet conversion because it happens in the background—yet noticeably, flawlessly. This frictionless operation aligns with growing consumer expectations for instant, invisible finance.

As one merchant survey respondent emphasized, “When payouts move as naturally as sending a message, customers stay loyal.”

Setting Up DivisaWallet-to-PayPal Transfer: Step-by-Step For users ready to activate this feature, the process is straightforward: 1. Open both the Goethe Wallet app and PayPal, ensuring they are updated and authenticated. 2.

Navigate to Settings > Linked Accounts or Wallets. 3. Select “Connect PayPal Wallet” and authorize the connection via secure QR scan or one-time code.

4. Review available balance and confirm transfer initiation—no manual input needed beyond authentication. 5.

Monitor real-time transfer status through in-app notifications; funds typically reflect in PayPal within seconds. For businesses managing recurring flows, scheduling periodic transfers directly from Goethe Wallet simplifies cash flow planning. Support teams remain accessible for troubleshooting, but the user Experience stays transparent and low-effort.

Not all balances are instantly transferable—minimum thresholds and holding periods may apply, reflecting standard risk management. Typically, once funds pass verification, they’re available within 30 seconds. Some geopolitical restrictions or verified user status may accelerate or delay settlement, but real-time tracking provides clarity.

This reliability rivals traditional banking in speed while eliminating cumbersome paperwork. For digital citizens accustomed to instant gratification in apps, this level of responsiveness is not just convenient—it’s expected.

The Future of Cross-Platform Financial Flow As digital payments grow more interconnected, integrations like the Goethe Wallet-to-PayPal transfer represent a shift toward frictionless finance.

With improvements in API standardization, AI-driven fraud detection, and expanded currency support, such transfers are poised to become standard—elevating user trust and lowering barriers to global commerce. For individuals and enterprises alike, this capability transforms mobile wallets from passive storage into active financial engines. In a world where speed and accessibility define competitive advantage, mastering seamless wallet-to-wallet movement is no longer optional—it’s essential.

Users who embrace this integration gain more than speed: they gain control, clarity, and confidence in an increasingly borderless financial landscape.

Related Post

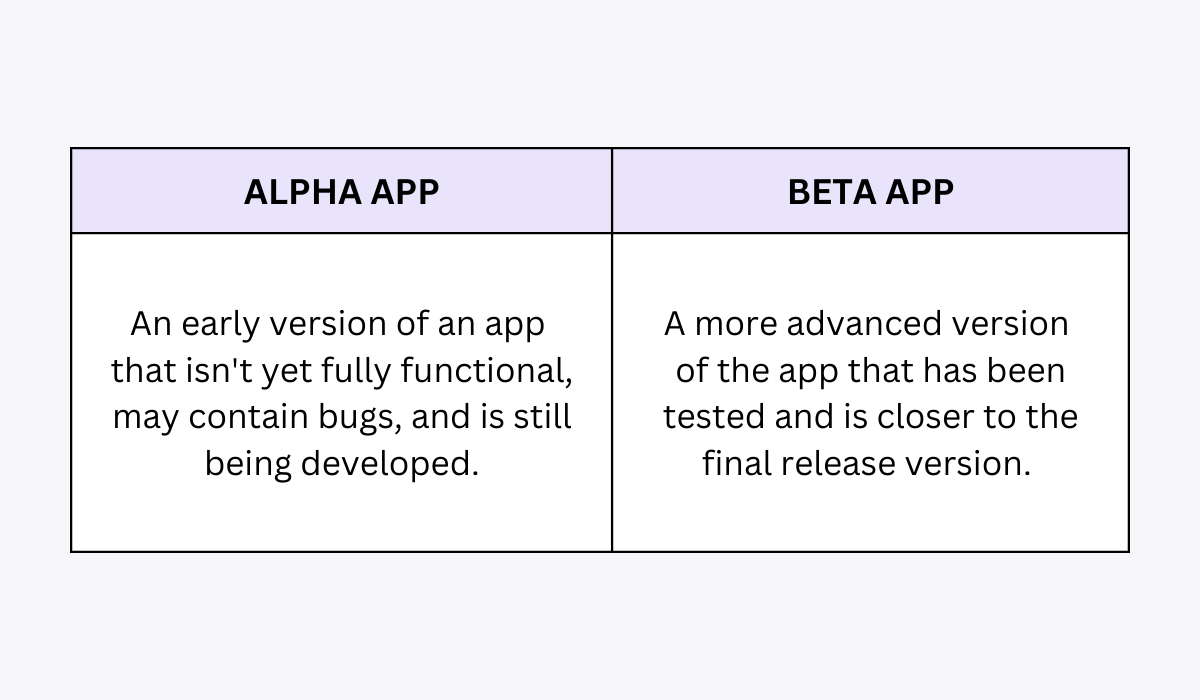

Alpha vs Beta: Understanding the Core Dynamics That Shape Product Success

Cree Cicchino Movies Bio Wiki Age Height Boyfriend Game Shakers Now and Net Worth

Smokie Norful Church Bio Wiki Age Wife Son Daughter Songs and Net Worth