Entendendo AL FID AYMORE CFI SA: Guia Completo para Gestão de Risco e Compliance no Setor Financeiro

Entendendo AL FID AYMORE CFI SA: Guia Completo para Gestão de Risco e Compliance no Setor Financeiro

In the evolving landscape of financial services, where regulatory scrutiny and internal controls define operational resilience, AL FID AYMORE CFI SA emerges as a pivotal institution dedicated to embedding transparency, accountability, and risk mitigation through its comprehensive compliance and fiduciary frameworks. As a specialized financial services firm, AL FID AYMORE positions itself as a trusted partner for organizations navigating complex regulatory environments—from audit readiness and antifraud protocols to fiduciary responsibilities and governance excellence. *“AL FID AYMORE CFI SA doesn’t just meet compliance standards—it sets a benchmark for fiduciary integrity in Latin America’s financial sector.”* This article delivers a definitive guide to the institution’s core principles, structural strengths, and practical applications for businesses and professionals seeking to strengthen their internal controls and risk governance.

Core Pillars of AL FID AYMORE CFI SA: Structure and Expertise

AL FID AYMORE CFI SA operates at the intersection of financial oversight and strategic advice, leveraging a multidisciplinary team of legal experts, risk analysts, and compliance officers. The firm’s framework is built on three foundational pillars: - **Robust Risk Management Systems**: Designed to identify, assess, and mitigate operational, financial, and reputational threats before they escalate, using advanced analytics and scenario modeling. - **Fiduciary Integrity Framework**: Emphasizing duty-based governance, ensuring that fiduciaries uphold the highest standards of loyalty, care, and transparency in managing assets and rights on behalf of clients or stakeholders.- **Regulatory Excellence**: Maintaining rigorous adherence to national and international standards, including AML (Anti-Money Laundering), KYC (Know Your Customer), and local financial reporting laws, supported by real-time monitoring tools. These pillars are reinforced by a culture of continuous education, with in-house training programs tailored to evolving regulatory demands—ensuring clients not only comply but also anticipate market shifts.

Innovative Compliance Solutions Tailored to Diverse Financial Needs

What distinguishes AL FID AYMORE CFI SA is its ability to deliver customized compliance solutions across a spectrum of financial operations.The firm’s service portfolio spans: - **Comprehensive Internal Audits**: Structured assessments that evaluate control efficacy, operational efficiency, and regulatory alignment, producing actionable insights for executive decision-making. - **Fraud Prevention Architecture**: Proactive systems combining behavioral analytics, transaction surveillance, and whistleblower mechanisms to detect early warning signs and prevent financial misconduct. - **Fiduciary Risk Advisory**: Strategic guidance on asset management mandates, succession planning, and conflict-of-interest protocols, particularly relevant for pension funds, trusts, and corporate governance bodies.

- **Digital Compliance Platforms**: Integration of cutting-edge fintech tools enabling automated reporting, real-time audit trails, and scalable monitoring tailored to SMEs and institutional clients alike. For instance, the firm’s proprietary risk dashboard allows clients to visualize vulnerability indicators across departments, turning complex data into clear, strategic priorities—a tool praised by industry partners for reducing compliance reaction time by over 40%.

Real-World Impact: Case Studies and Industry Applications

AL FID AYMORE CFI SA’s methodologies have proven effective across sectors, notably in banking, fintech, and private wealth management.A major regional bank, constrained by tightening capital adequacy rules, partnered with the firm to overhaul its internal audit protocols. Within nine months, the bank reduced compliance violations by 62% and enhanced capital reserve forecasting accuracy through AL FID AYMORE’s predictive modeling tools. Similarly, a fintech startup leveraged the firm’s fiduciary governance framework to secure investor confidence, successfully closing a $15 million funding round amid heightened regulatory scrutiny in digital asset custody.

These outcomes illustrate AL FID AYMORE’s role not only as a risk mitigator but as a catalyst for business growth through operational clarity and stakeholder trust.

Best Practices for Maximizing AL FID AYMORE CFI SA’s Expertise

To fully harness the firm’s capabilities, organizations must adopt proactive engagement strategies: - **Early Integration**: Embedding AL FID AYMORE’s compliance architects in strategic planning phases ensures alignment with regulatory expectations from project inception. - **Continuous Training**: Regular workshops and compliance refreshers for internal teams reinforce adherence and foster a culture of accountability.- **Technology Adoption**: Leveraging the firm’s digital tools—such as automated reporting modules and real-time risk monitoring—streamlines operations and ensures accurate, audit-ready documentation. - **Transparent Communication**: Open channels for feedback and audit transparency strengthen collaboration and enable swift corrective action. These practices not only optimize risk outcomes but also align with broader ESG (Environmental, Social, Governance) goals increasingly demanded by investors and regulators.

In an era where financial stability hinges on vigilant governance, AL FID AYMORE CFI SA stands at the forefront, combining institutional rigor with innovative technology to safeguard assets, reinforce fiduciary duty, and drive operational excellence. For organizations committed to long-term resilience, partnering with AL FID AYMORE isn’t just a compliance choice—it’s a strategic imperative.

Related Post

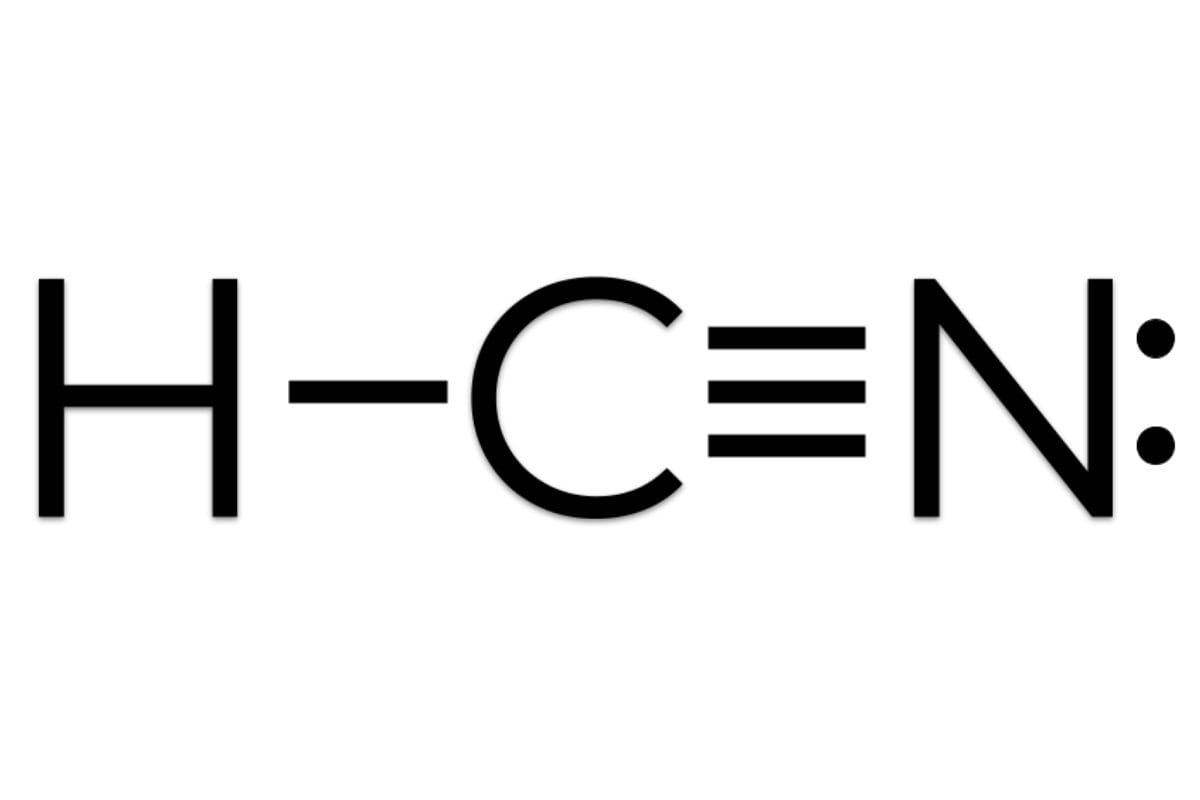

Unlocking the Chemistry Behind Hydrogen Cyanide: The Precision of Its Lewis Structure

The Visionary Behind Barbie: The Legacy of Ruth Handler, Toy Titan and Architect of a Cultural Icon

Mastering the Arduino Voice Module: Integration, Programming, and Advanced Applications