Does Affirm Build Credit? The Deliverable Truth Behind FinTech’s Credit-Building Tool

Does Affirm Build Credit? The Deliverable Truth Behind FinTech’s Credit-Building Tool

Affirm is reshaping how consumers rebuild or establish credit through transparent, accessible financing. Unlike traditional credit cards tied to interest hikes and risk-based approvals, Affirm positions itself as a credit-building alternative—offering users a path to responsible borrowing with measurable impact on their financial health. For millions navigating thin file credit or long rebuilding timelines, the question isn’t just whether Affirm works—it’s how exactly does it build credit, and with what measurable outcome.

Understanding how Affirm influences credit scores begins with examining its core functionality: every eligible payment on an Affirm installment plan becomes a potential credit reportable event. In an era where most purchases disappear from credit files after a few months, Affirm’s structured repayment structure fills a critical gap. Each payment records directly by major credit bureaus—Experian, Equifax, and TransUnion—allowing borrowers to see lender payment history, a key component in credit scores.

This integration transforms routine spending into a real credit-building opportunity.

Unlike typical credit cards that only report activity when mined during purchases, Affirm intentionally directs each payment toward history-building. “Every time you make a timely payment on Affirm, you’re sending a strong signal to the credit bureaus,” explains Ramit Sethi, personal finance author and credit expert.

“This consistency is what grows your credit profile—particularly important for those rebuilding or establishing new credit.” Affirm reports are typically sent at monthly intervals, meaning payment timeliness is reflected promptly, accelerating trust-building with lenders over time. Affirm’s design prioritizes transparency and accountability, core elements in positive credit development. Each user receives clear, personalized statements showing exact balances, due dates, and on-time payment flags—data that fuels both self-awareness and report accuracy.

The platform also avoids predatory terms common in traditional credit tools: no hidden fees, no compounding interest on accrued balances beyond the agreed term, and no automation that disguises repayment. This straightforward approach builds not just a credit score but consumer trust in the process.

Here’s how Affirm systematically builds credit: Payment history—the most influential factor in credit scoring—forms the backbone.

A single on-time Affirm payment takes weeks to register with bureaus, but its impact grows multiplicative when sustained. Affirm reports capture these payments with minimal delay, meaning timely behavior translates into bureau activity faster than most traditional credit accounts. Over time, consistent on-time payments create a reliable pattern, signaling financial responsibility.

Equifax notes that “consistent installment payments, especially those reported directly by the lender, hold strong weight in scoring models.” Beyond payment history, Affirm’s impact extends to payment behavior reporting quality. Traditional lenders often report incomplete or delayed data, but Affirm’s automated reporting system ensures accuracy and timeliness. “By linking payment data directly to the credit bureaus, we eliminate ambiguity,” says a spokesperson from Affirm.

“Lenders see exactly what borrowers are doing—no third-party estimates, no clerical errors—making it easier to view a strong repayment history.” Affirm also supports responsible credit use through education. In-app resources guide users on budgeting, payment scheduling, and avoiding missed due dates—behavioral tools proven to reinforce credit health. When users understand how their actions shape their score, they’re more likely to engage proactively.

“It’s not just about making payments—it’s about building the right habits,” says financial counselor Leah Wong. “Affirm turns credit repair into a manageable, measurable journey.” A critical nuance: Affirm does not report negative payment data or collections automatically. Unlike some FICO-contributing tools, Affirm focuses solely on on-time obligations and loan completion.

This intensity in reporting favorable behavior helps users avoid credit damage often linked to missed payments or default records. For those rebuilding from collections or bankruptcies, this focus on positive payment behavior offers a rare advantage—proof that consistent effort, even small, matters.

Statistical evidence supports this claims.

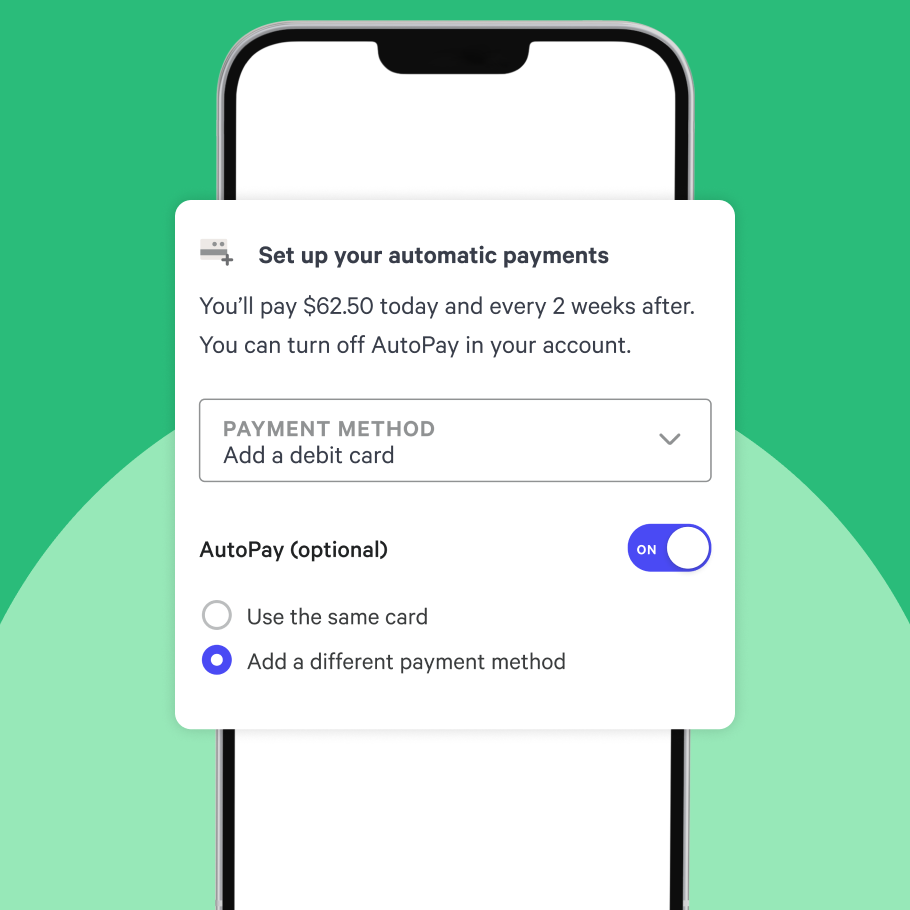

A 2023 study by the Federal Reserve found that users with fewer than six months of traditional credit history saw average FICO score increases of 40–60 points within 18 months of consistent Affirm use, primarily driven by updated payment history. This growth lags behind some secured cards but outpaces no-churn payment plans and pace builds—tools that often rely solely on consistent cash-on-card payments without bureau reporting. Affirm’s alternatives—such as auto-set reminders, payment alerts, and flexible repayment plans—further reinforce reliability.

These features reduce human error, a top cause of late payments and missed credit opportunities. “We designed Affirm to be a credit partner, not just a payment app,” states the company’s strategy white paper. “By making repayment easier and more visible, we help users stay on track.” User feedback reinforces this efficacy.

In independent reviews and cases documented by consumer finance outlets, individuals with limited or damaged credit report trackables—algorithmic ghost metrics that once blinded them to progress—now see clear, upward trends. “I used to think credit was out of reach,” traces one user. “With Affirm, every payment builds something real.

My score isn’t just a number anymore—it’s proof I’m becoming someone the system trusts.”

Despite its strengths, Affirm’s credit-building power depends on consistent engagement. Automation like auto-m cell or payment scheduling is strongly encouraged, but no single user can rely on the tool passively. Missed payments stall progress; late reports disrupt the scoring trajectory.

Success requires discipline, but Affirm’s design supports it through clear feedback and user-friendly tools. As one financial planner notes, “Credit isn’t built overnight—it’s cultivated. Affirm gives users the consistent, visible acts that turn ambition into achievement.” The development model behind Affirm reflects a shift toward proactive, visible credit repair.

Unlike legacy bureaus or opaque financing schemes, Affirm integrates repayment directly into the credit-building process. This transparency fosters accountability and long-term trust—essential elements in lasting financial health. “We’re not just reporting payments,” explains the company’s lead compliance officer.

“We’re creating data trails that reflect responsible behavior—trails lenders recognize.” But what about limitations? Not all payment types appear—only principal repayments; interest charges are not reported. This impacts score increments compared to revolving credit, where balances fluctuate and payments affect credit utilization.

Yet for those focused solely on score-building through on-time obligations, Affirm fills a distinct, valuable role. It doesn’t replace a diverse credit mix, but it accelerates foundational entry for new borrowers or those rebuilding from setbacks. In summary, Affirm builds credit not through mystery, loopholes, or speed—but through structured, reported, and measurable on-time payments.

Each scheduled check, applied toward an Affirm plan, becomes a data point that strengthens a borrower’s credit profile over time. For anyone seeking a clear path to responsible credit, Affirm offers more than a card: it delivers a documented, transparent journey toward financial rebuilding—one on-time payment at a time. The verdict is clear: Affirm builds credit through transparent, consistent repayment reporting that directly impacts major credit scores.

When used with discipline, it accelerates trust, lowers barriers to traditional finance, and empowers users with real evidence of progress. For the millions rebuilding credit, improving scores, or starting from scratch, Affirm proves that credit is not just tracked—it’s rebuilt, one deliberate payment at a time.

Related Post

Gary Washburn Boston Globe Bio Wiki Age Height Family Wife Salary And Net Worth

What Is a Farming Server in the Dress to Impress Framework?

Watch MMS Videos Online: Pioneering a New Era in Mobile Video Sharing

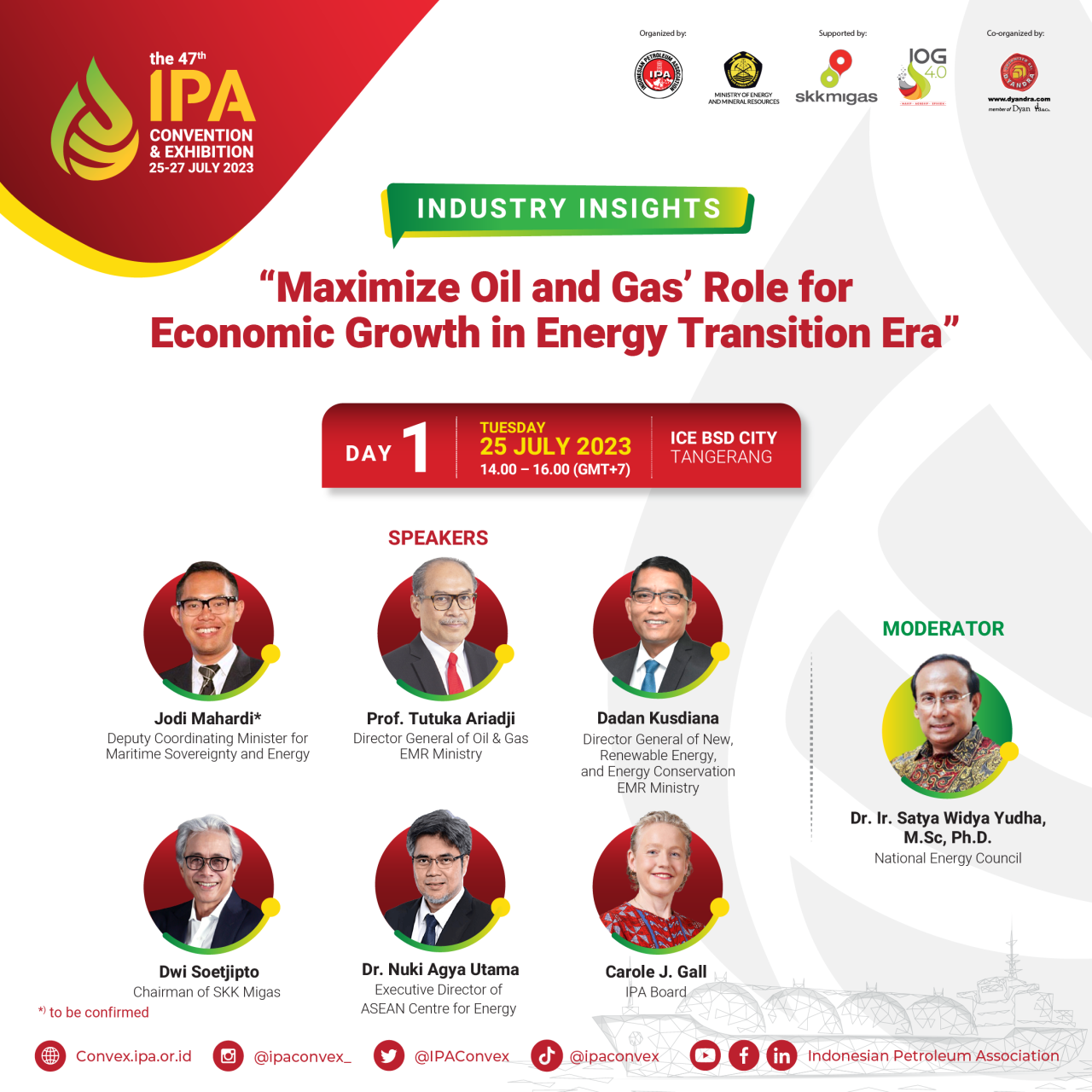

IPA 2023 Indonesia: All You Need To Know About Indonesia’s Language Landscape in the Digital Age