Decode the Wells Fargo Routing Number: The Key to Smarter Banking Transactions

Decode the Wells Fargo Routing Number: The Key to Smarter Banking Transactions

Every time a check clears or a direct deposit hits your Wells Fargo account, a silent but vital component powers the process: the Wells Fargo routing number. These nine-digit sequences are the unsung architects behind secure, accurate money movement across the banking network—yet few understand their full significance. Beyond mere identification, the routing number governs transaction routing, ensures secure fund transfer, and maintains efficiency in an increasingly digital financial ecosystem.

Understanding its function empowers consumers to avoid common errors and streamline their daily banking.

Each Wells Fargo routing number follows a standardized format: the first four digits (001–021) denote the institution’s Federal Reserve member bank code, the fifth digit identifies the specific district transfer system, and the final four digits pinpoint the financial institution’s local processing center. Originally introduced with the Federal Reserve’s ABA (American Bankers Association) routing system in 1910, these identifiers have evolved to keep pace with technological advances—from paper checks to real-time payments.

Wells Fargo’s routing details, for instance, enable precise routing not just domestically across U.S. banks but increasingly within instant payment networks like The Clearing House’s RTP® system.

The Critical Role of Routing Numbers in Daily Banking

At its essence, the Wells Fargo routing number directs where money goes.When initiating a wire transfer, setting up automatic payments, or processing a check deposit, this number ensures funds reach the correct intermediary and destination institution. Without it, transactions face delays, losses, or outright rejection. Why it matters: - **Transaction Precision:** The routing number allows the Federal Reserve’s ACH network to shuffle money through the appropriate clearinghouse, minimizing errors.

- **Security Layer:** Routing numbers are indispensable for verifying transaction legitimacy, reducing fraud risk. - **Efficiency in Clearance:** They streamline settlement by categorizing payments across networks, cutting processing time and clearing bottlenecks.

For Wells Fargo customers, recognizing the routing number—typically located at the bottom of checks between the bank name and account number—unlocks redundancy and control.

Whether setting up direct deposits or verifying payment recipients, accessing the correct routing number is non-negotiable for operational integrity. “A missing or incorrect routing number is like sending mail without the right address,” explains financial services analyst Sarah Chen. “It can delay payments by days or trigger unintended downturns in transaction flow.”

Mastering Location-Based Routing: ‘Deposits Only Where Opported’

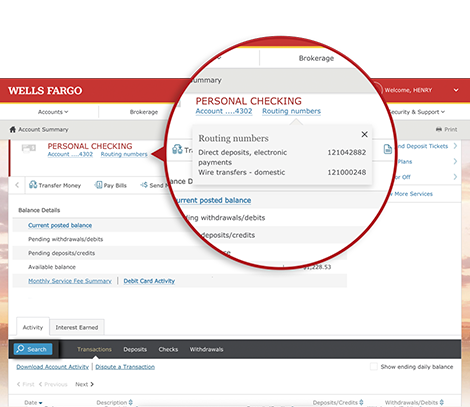

Wells Fargo’s routing number structure reflects a deliberate geographic segmentation.Each nine-digit code aligns with the bank’s regional processing footprint across states like California, Texas, and the Northeast. This localization ensures transactions travel the most efficient path, leveraging nearby clearing centers and reducing transmission latency. For high-volume users—such as small business owners or payroll administrators—this precision translates into predictable, reliable fund movement.

For example, a payroll deposit into a Wells Fargo account in Los Angeles routes through the bank’s West Coast clearing hub, ensuring immediate deposit availability. Meanwhile, direct deposits for out-of-state residents are automatically routed via the primary routing number registered with the Federal Reserve, bypassing redundant checks and ensuring same-day processing. This seamless routing, though invisible to users, is foundational to Wells Fargo’s service reliability.

As one regional bank operations manager noted, “Our routing strategy isn’t just about numbers—it’s about mapping financial geography to deliver real-time outcomes.”

How to Find and Use Your Wells Fargo Routing Number Safely

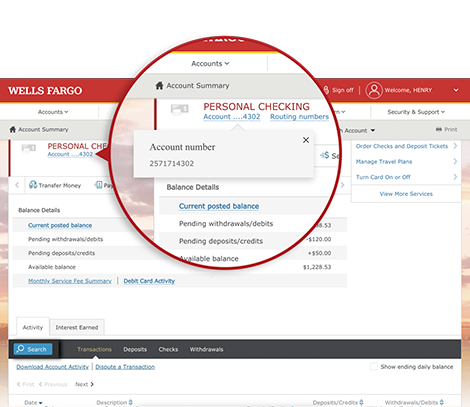

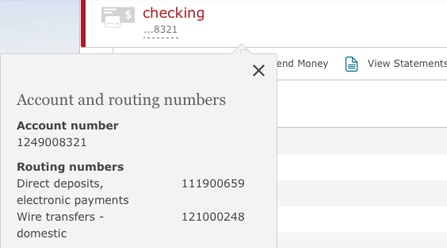

Locating your routing number has never been simpler. For check-based accounts, the number is printed bottom-center alongside account and routing details. For electronic transactions—wire transfers, ACH payments, or mobile deposits—it’s embedded within Wells Fargo’s online portal, mobile app, or automated clearing household (ACH) forms.Users are strongly advised to verify the routing number each time, especially when enrolling in new payment systems or changing routing for business payroll accounts.

Security remains paramount. Phillips, cybersecurity specialist at the Financial Trust Institute, cautions: “Always confirm the routing number directly with Wells Fargo or through official banking channels.

Third-party sites claiming routing number lookups without verification risk phishing or fraud.” For recurring payments, using the exact number reduces processing failures—critical for payroll, insurance premiums, and vendor invoices. Most digital wallets and banking platforms auto-populate routing numbers, but manual verification ensures accuracy before finalizing transactions.

Emerging Trends: From Routing Numbers to Real-Time Payments While traditional ACH routing via routing numbers supports over 10 billion domestic transactions annually, Wells Fargo and other banks are integrating cutting-edge payment rails.

The RTP® network, powered by The Clearing House, enables instant fund transfers using unique transaction IDs—not just routing numbers—ushering in a new era of real-time settlement. Though routing numbers still anchor legacy systems, advancements like ISO 20022 data standards and AI-driven fraud detection are enhancing how payments are authenticated and tracked.

Wells Fargo has incorporated these innovations by expanding roving routing capabilities for mobile deposits through image capture technology, reducing dependency on static numbers alone.

Yet routing numbers remain a foundational layer, bridging old and new systems. “Our infrastructure is hybrid,” explains a Wells Fargo client services representative. “Routing numbers ensure compatibility across decades of banking systems, while modern protocols meet today’s speed demands.”

The Future of Routing: Greater Transparency and Control

Looking forward, the role of routing numbers in banking is evolving toward enhanced transparency.Regulatory initiatives push for clearer customer disclosures, ensuring users understand what each number enables and protects. Wells Fargo has responded by improving digital will-they-warn-customers-of-routing-choices and enabling real-time verification through secure key-based authentication. These steps build consumer trust and reduce friction.

For individual customers and business clients alike, the Wells Fargo routing number remains a vital tool—not just for moving funds, but for maintaining control in a fast-moving financial landscape. As transaction complexities grow, mastering this simple sequence empowers users to navigate payments with confidence, accuracy, and peace of mind. In a world where speed and precision define modern banking, the routing number is not just a code—it’s a gateway to reliability.

By understanding its structure, recognizing its irreplaceable role, and adopting best practices for usage, users transform a routine banking detail into a strategic advantage. The Wells Fargo routing number, born from over a century of financial innovation, continues to power the backbone of safe, efficient payments—proving that sometimes the most powerful tools are the ones we don’t see.

Related Post

Find Your Wells Fargo Routing Number in Seconds — Mastering the Quick Routing Number Find

Phil McGraw Dr Phil Bio Wiki Age Height Wife Sons Tv Shows and Net Worth

Dan Rafael: The Voice of Boxing Journalism – A Career Retrospective

Ewan McGregor’s Age at Star Wars Episode I: What Hidden Bio Facts Reveal About the Jedi Actor