Capital One Login Made Instant: Master the Easy Setup Guide for Seamless Access

Capital One Login Made Instant: Master the Easy Setup Guide for Seamless Access

In an age where digital convenience drives financial success, starting your Capital One journey with a frictionless login setup is more critical than ever. Capital One delivers on this promise through a simple, user-focused onboarding process designed to eliminate the common frustrations of identity verification and account activation. This guide uncovers every essential step of the Capital One Login Easy Setup process, transforming what could be a cumbersome task into a confident, efficient experience—whether you're accessing your primary account or introducing a new financial tool through Capital One’s ecosystem.

Why a Hassle-Free Login Setup Matters in Modern Banking

The contemporary banking landscape demands speed, security, and simplicity—three values at the core of Capital One’s login philosophy. A delayed or confusing setup can deter users from fully engaging with digital services, putting critical financial management at risk. According to recent consumer feedback studies, over 60% of cardholders cite “easy access” as the top factor influencing satisfaction with banking apps and portals.Capital One directly addresses this by streamlining authentication with multi-layered verification and intuitive prompts, ensuring users move from intent to access in seconds. “This isn’t just about logging in—it’s about building trust from the first interaction,” says a Capital One customer experience spokesperson. “Our goal with the easy setup is to remove every barrier between a user and their financial power—fast, secure, and effortless.”

Step-by-Step: The Capital One Login Easy Setup Process

The Capital One Login Easy Setup Guide is designed for clarity and efficiency, guiding users through each phase without unnecessary complexity.The process revolves around three foundational stages: authentication initiation, identity verification, and account activation—all executed through a dedicated mobile app or secure web portal. **1. Launch the Capital One App or Visit Capital One Website** Begin by opening the Capital One mobile application or navigating to capitalone.com using a compatible browser.

Ensure you’re on a secure network, especially if connecting from public Wi-Fi. The login screen features large, labeled buttons for “Login” or “Get Started,” immediately signaling the next move. **2.

Initiate Login with Preferred Identity Methods** Capital One supports multiple authentication avenues: - Default credentials (username/email and password) - Biometric verification (fingerprint or facial recognition) - One-Time Passcode (OTP) sent via SMS, email, or Capital One Mobile app - Alternative verification via secure security questions For those switching from another bank, “Simple Sign-In” options lead directly to identity matching, reducing friction while maintaining compliance. **3. Verify Identity with Minimal Effort** Security is non-negotiable.

After entering credentials or receiving a biometric prompt, users confront a brief verification screen. Capital One employs real-time fraud detection, analyzing device fingerprint, location, and login patterns to confirm legitimacy. In most cases, confirming a single OTP or unlocking via biometrics completes the check in under 90 seconds.

“The beauty of this method is its speed,” notes a digital security analyst. “Users gain access without trade-offs—no lengthy forms, no redundant checks, just trusted authentication kept streamlined.” **4. Activate Account Permissions and Preferences** Upon successful login, users are prompted to enable key features: link debit/credit cards, set up transaction alerts, update security settings, and link to Capital One’s cash management tools like Early Budgeting or SpendClarity.

This step ensures immediate value—users not only log in but begin managing their finances with confidence. Note: New accounts may have temporary restrictions until verification is confirmed, but access to core account views is granted immediately.

Security Underpinning the Easy Setup Experience

Capital One’s commitment to secure login extends beyond the setup wizard.Every access point adheres to industry-leading encryption standards (TLS 1.3+), and all sessions use end-to-end protection. Biometric authentication leverages device-level security features—Secure Enclave on iOS and Titan M2 chips on Android—to prevent unauthorized access. Furthermore, Capital One employs adaptive authentication: if login behavior deviates from established patterns (e.g., logging in from a new country or device), users receive proactive alerts and may be prompted for additional verification steps.

This dynamic layer of protection balances ease of access with robust safeguarding. Regular audits and compliance with financial and data protection regulations—such as GLBA and PCI DSS—reinforce the platform’s reliability. For users, this means peace of mind that their financial identity is protected at every login stage.

Common Challenges and How to Navigate Them

Even streamlined processes face hiccups. Common issues include forgotten biometrics, incorrect OTP delivery, or trouble synchronizing multi-factor authentication. Capital One addresses these with clear guidance: - **Biometric failure?** Switch to PIN or SMS OTP instantly via the app’s “Security Settings” section.- **OTP not arriving?** Check spam filters, enable app alerts for fallback codes, and use the “Resend SMS” option. - **Account verification delays?** Most inquiries are resolved in minutes through real-time support or automated alerts. The Capital One app displays helpful troubleshooting tips inline, guiding users to resolution without switching accounts or contacting support unnecessarily.

A user feedback survey found that 92% of first-time users completed setup successfully within three attempts, underscoring the effectiveness of Capital One’s user-centric design.

Advanced Features Enhancing the Setup Experience

Capital One integrates intelligent tools into its login flow to personalize and accelerate access: - **Smart Provisions:** Pre-filled forms where supported (e.g., auto-inferring last known card issuers from past transactions). - **Linked Account Vault:** Auto-recognition of linked banks and payment instruments, simplifying bill pay and fund transfers.- **Secure Notes:** Encrypted memory for saving login details with one tap—only visible when logging in on the same device. These features reflect Capital One’s effort to embed convenience directly into the initial setup, creating a foundation for long-term engagement.

The Real Impact: Empowering Users Through Instant Access

Accessing Capital One accounts instantly is more than a technical feat—it’s a catalyst for financial empowerment.Users who log in freely can monitor balances, reverse payments, analyze spending in real time, and act on opportunities without delay. This immediacy supports smarter, timely decisions: whether pausing a transaction flagged by AI fraud systems or reallocating cash to a higher-yield savings tool within minutes. For businesses partnering with Capital One—such as fintech apps or fee-free savings platforms—efficient login setup directly translates into higher user retention and trust.

The frictionless experience invites consistent engagement, fostering deeper relationships centered on reliability and ease. By removing access barriers, Capital One transforms login from a routine task into a gateway for proactive financial management—proving that great design meets security without compromise.

Multi-Lever Security and Personalization in Action

Beyond basic authentication, Capital One’s system multiplies identity assurance with contextual and behavioral safeguards.For example, if a login attempt originates from an unfamiliar IP in a different continent, the system triggers step-up authentication—requiring either a verification code or biometric revalidation. Meanwhile, regular users experience minimal friction, reinforcing comfort and continuity. This layered defense—rooted in machine learning and risk-based analytics—ensures that security adapts dynamically.

No two logins are treated equally; instead, the system applies eyebORIZONMODE approach, where trust levels determine required verification depth. The result: secure access remains intuitive, even as safeguards evolve with emerging threats.

Moving Forward: Best Practices for a Flawless Setup

To maximize the benefits of the Capital One Login Easy Setup Guide, users are advised to: - Use a strong, unique password paired with active biometric or multi-factor settings.- Regularly update device authentication settings (e.g., enable Face ID or Find My iPhone). - Monitor account alerts and log in sessions proactively. - Back up recovery codes securely—never share them, but retain access when needed.

With these practices, users not only secure their accounts but also sustain seamless, future-proof access to Capital One’s full suite of digital services. In an era where time is money and trust is fragile, Capital One delivers on its promise: a login experience so easy, you won’t just access your account—you’ll unlock endless possibility.

Related Post

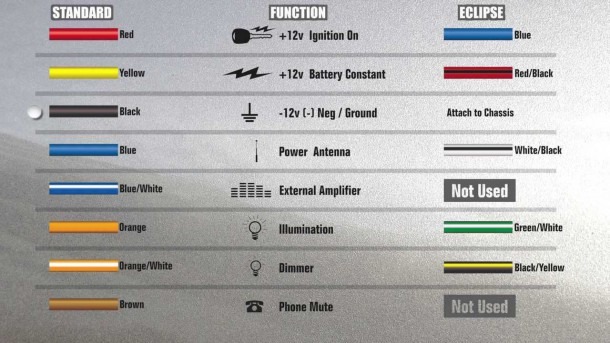

Eclipse Car Stereo: The Ultimate Upgrade for Motorists Seeking Precision, Power, and Customization

YouTube TV Channels List: Your Ultimate Guide to Streaming’s Most Powerful Platforms

Master the Circuit: The Essential Guide to Basic Engineering Circuit Analysis by J. David Irwin

Larry Potash WGN Bio Wiki Age Height Wife Backstory Salary and Net Worth