Bank on Your Future: Yahoo Finance Explained the Basics for Beginners

Bank on Your Future: Yahoo Finance Explained the Basics for Beginners

For millions navigating the complex world of investing, Yahoo Finance Explained serves as an essential gateway—transforming financial jargon into clear, actionable knowledge. Whether you're curious about stock markets, mutual funds, or retirement planning, understanding core financial principles demystifies investing and empowers smarter decisions. This guide unpacks the fundamentals with precision, helping beginners build a solid foundation for long-term financial success.

Investing need not feel intimidating. At its core, investing involves allocating money today with the goal of generating returns over time. Yahoo Finance Explained breaks this concept into digestible components, starting with the foundational principle that risk and return are intrinsically linked.

Higher potential returns typically come with greater uncertainty, a dynamic investors must master early. As Yahoo Finance explains, “The key to profitable investing lies in aligning risk tolerance with investment time horizon and financial goals.”

Understanding Asset Classes and Diversification

A well-structured portfolio hinges on diversification across asset classes—each offering distinct risk-return profiles. Yahoo Finance identifies four primary categories that form the bedrock of most investment strategies:- Stocks: Represent ownership in companies and offer growth potential through capital appreciation and dividends.

Historically, equities have delivered higher long-term returns than other assets, though with greater volatility.

- Bonds: Debt securities issued by governments or corporations provide regular income and stability. They act as a buffer during market downturns, reducing overall portfolio risk.

- Cash and Cash Equivalents: Includes savings accounts and money market funds. These preserve capital and offer liquidity, essential for emergency funds and short-term needs.

- Alternative Investments: Broader than traditional stocks and bonds, assets like real estate, commodities, or private equity can hedge against inflation and market swings when properly incorporated.

“Beta diversification is not just about owning many stocks,” Yahoo Finance emphasizes. “It’s about ensuring your portfolio reacts predictably to market shifts through exposure to bonds, international markets, and alternative assets where appropriate.”

Diversification isn’t merely about spreading investments—it’s about understanding correlation. Stocks in different sectors or geographies often move independently, reducing collective risk.

A balanced portfolio might include 60% stocks, 30% bonds, and 10% alternatives, but each weight should reflect personal risk capacity and financial objectives. Yahoo Finance’s interactive tools help beginners visualize optimal allocations tailored to their unique circumstances.

The Mechanics of Stock Markets and How to Start Investing

The stock market functions as a dynamic trading platform where shares of publicly traded companies change hands based on supply and demand. Yahoo Finance demystifies how it operates, emphasizing that indirect participation through investment accounts avoids direct market exposure risks.Investing begins with selecting a brokerage. Modern platforms—many powered by Yahoo Finance’s trusted data—offer low-cost trading, research tools, and educational resources. Accounts range from dipping toes into ETFs with mini-lot options to building diversified, fully managed portfolios.

Key steps for new investors:- Clarify financial goals: short-term savings versus long-term wealth building.

- Assess risk tolerance: how much volatility or loss can you withstand?

- Choose an appropriate account—Negotiable Market Account (NMA), IRA, Roth IRA—leveraging tax advantages.

- Start small: even modest monthly contributions benefit from compounding.

- Leverage educational tools: Yahoo Finance’s real-time charts, earnings updates, and market analytics help informed decision-making.

“Beginners shouldn’t wait for the perfect market or all the knowledge,” it advises. “Regular investing—dollar-cost averaging—smoothes out price volatility and fosters discipline.”

Technical analysis—reading price charts and indicators—is another cornerstone. While fundamental analysis focuses on company financials and growth potential, Yahoo Finance explains that technical training helps identify entry and exit points, tailoring strategies to market sentiment and trends.

The Role of Fees, Taxes, and Costs in Investment Returns

Hidden costs can erode returns over time, often unnoticed by novice investors.Yahoo Finance highlights three major expenses: management fees (for mutual funds and ETFs), trading commissions, and taxes. While brokerage commissions have nearly disappeared on many platforms, funds may impose expense ratios—annual fees that eat into profits year-round.

Tax efficiency amplifies net returns. Long-term holdings below standard deduction thresholds often benefit from lower capital gains tax rates.

Yahoo Finance recommends tax-advantaged accounts like IRAs and Roth IRAs for retirement planning, where tax-deferred or tax-free growth compounds wealth more effectively than taxable accounts.

Understanding expense ratios is vital: a 1% annual fee on $10,000 yields $100 in costs annually—far from negligible over decades. Yahoo Finance flags that low-cost index funds and ETFs consistently outperform high-fee actively managed funds, especially over time. “The market’s a net driver of wealth, not fees,” the guide asserts.

“Choose investments where cost is secondary to long-term growth.”

Long-Term Strategies and Psychological Discipline

Building lasting wealth is as much behavioral as strategic. Yahoo Finance Explained stresses that emotional decision-making— Panic selling during downturns, chasing hot trends—undermines even the best-laid plans. Discipline transforms intermittent participation into compounding success.Top habits among consistent investors include:

- Sticking to a predefined asset allocation.

- Rebalancing portfolios periodically to maintain target weights.

- Avoiding frequent trading; higher transaction costs and taxable events chip away at returns.

- Staying informed through trusted sources—Yahoo Finance provides timely news, analyst ratings, and market commentary.

“Consistency, even with modest contributions, compounds into significant wealth.”

Equally vital is maintaining perspective. Short-term volatility is normal; history shows markets tend to trend upward over 5-, 10-, or 20-year horizons. As behavioral finance insights reinforce, emotional resilience correlates strongly with performance.

Investors who understand this mental shift fare far better during periodic corrections.

Real-World Tools and Resources to Empower Beginner Investors

Yahoo Finance doesn’t stop at explanation—it equips readers with practical tools. From real-time portfolio dashboards and retirement calculators to personalized investment recommendations, the platform bridges knowledge gaps with actionable support. Its educational center features certified articles, video tutorials, and interactive calculators that help beginners simulate scenarios: What happens if I invest $300 monthly starting today?How does tax-advantaged status affect retirement savings? Popular Yahoo Finance resources include:

- Market Trackers: Real-time stock and ETF performance trends, sector rollovers.

- Compound Growth Simulators: Visual tools projecting how small, consistent investments grow over decades.

- Credit Ratings & Ratings Alerts: Trusted assessments of company health and fund performance.

- Personalized Portfolio Builder: Templates guiding allocation based on risk profiles.

- Tax Impact Calculators: Estimating after-tax returns from different account types.

By combining clear, jargon-free explanations with robust, actionable tools, Yahoo Finance Explained empowers beginners not just to start, but to sustain investment success.

It demystifies the complexities, replaces overwhelm with clarity, and builds the mindset needed for lifelong financial growth.

In a world where financial decisions shape futures, Yahoo Finance Explained does more than inform—it transforms curiosity into capability. For anyone ready to build wealth, understanding these fundamentals is not just an advantage; it’s the first step toward lasting prosperity.

Related Post

Dothan’s Development: How Ricky Stokes News Fuels Community Progress in Alabama’s Heartland

Seth Rollins Rocks Viral Giant Red Boots On WWE RAW

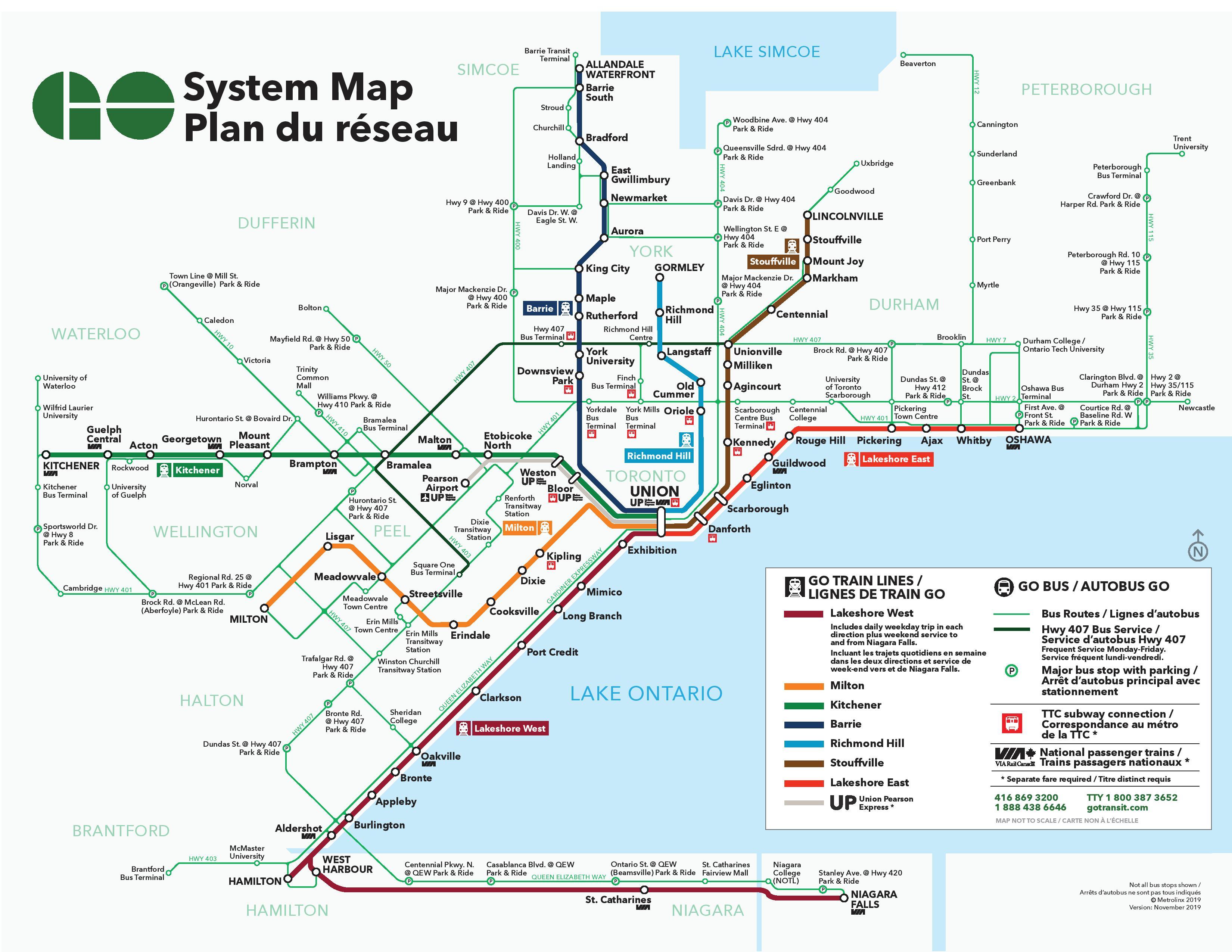

Behind the C Train Stops: How a Network Shapes Transit, Transit, and Community in Toronto

Bad Bunny’s Latest Track Splits the Beat and Language: English Translations Ignite Global Curiosity