Autofinance: Revolutionizing Financial Management Through Intelligent Automation

Autofinance: Revolutionizing Financial Management Through Intelligent Automation

In an era defined by rapid technological acceleration, Autofinance stands at the forefront of a paradigm shift in how individuals and institutions manage, analyze, and optimize financial operations. More than just a buzzword, Autofinance refers to the integration of artificial intelligence, machine learning, and automated workflows into every facet of personal and corporate finance—from budgeting and investment tracking to risk assessment and reporting. As financial ecosystems grow increasingly complex, this fusion of technology and finance promises not only efficiency but also deeper insights, predictive accuracy, and personalized decision-making.

Autofinance leverages advanced algorithms to perform repetitive, data-heavy financial tasks with minimal human intervention—transforming finance from a back-office function into a proactive, strategic driver. By automating data collection, reconciliation, and reporting, financial professionals and individuals alike gain instant access to real-time dashboards, anomaly detection, and scenario modeling. According to Autofinance experts, “The core value of Autofinance lies in its ability to convert vast data volumes into actionable intelligence, empowering users to shift from reactive to anticipatory financial management.”

Core Components Driving Autofinance Innovation

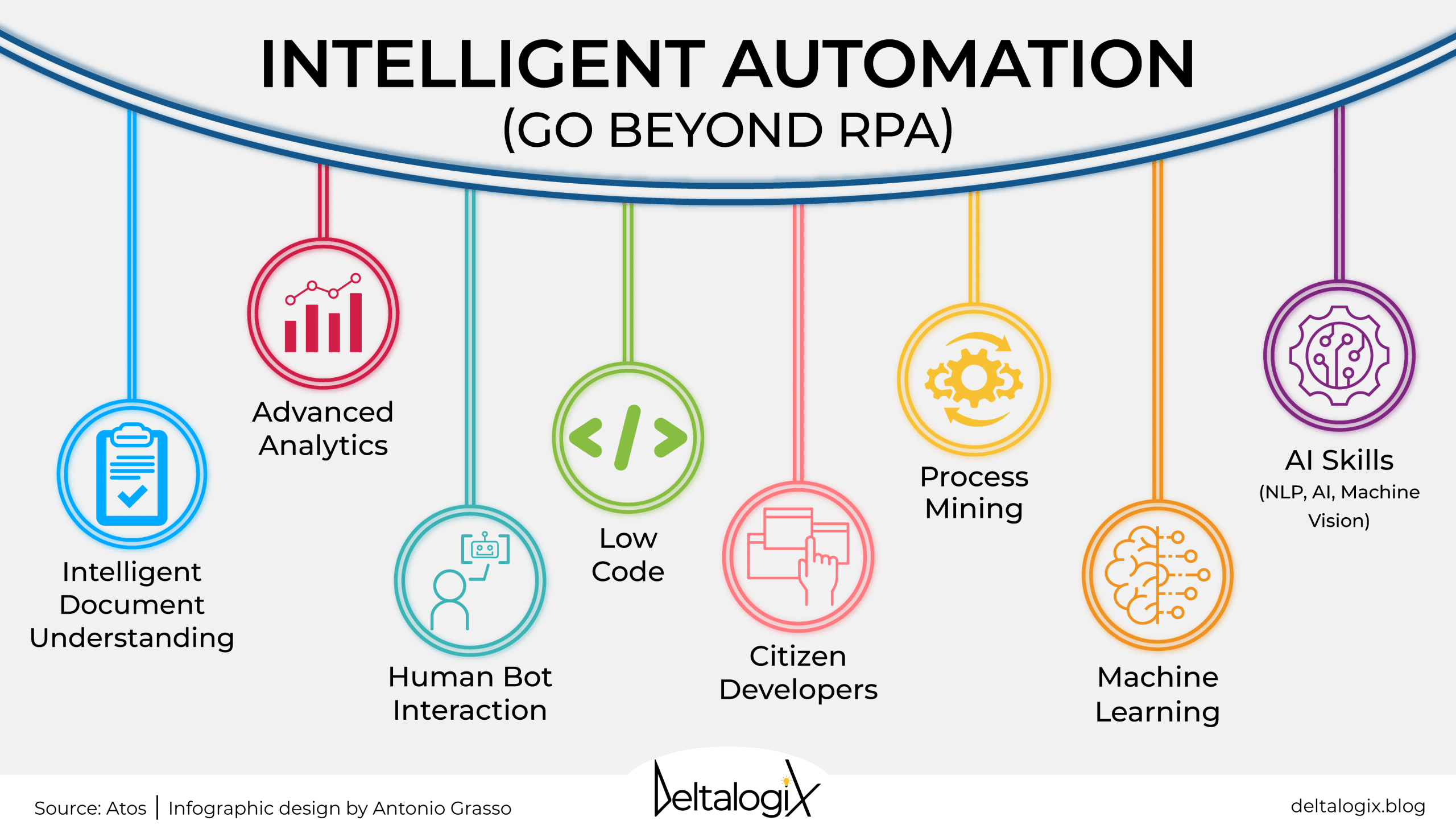

At its foundation, Autofinance relies on three key technological pillars: artificial intelligence, robotic process automation (RPA), and cloud-based data integration.Artificial Intelligence and Machine Learning AI engines within Autofinance platforms continuously learn from transaction patterns, market trends, and user behavior. This enables systems to detect irregularities—such as fraudulent transactions or budget overruns—before they escalate. Machine learning models refine fee structures, optimize investment allocations, and forecast cash flow with increasing precision over time.

“With AI at the helm, Autofinance transcends static reporting to deliver adaptive, self-improving financial oversight,” notes Dr. Elena Torres, a senior data architect at FinTech Innovations. “These systems don’t just store data—they interpret context, anticipate needs, and recommend optimal actions.” Robotic Process Automation (RPA) RPA automates rule-based, repetitive tasks such as invoice entry, expense reporting, and reconciliation across multiple banking feeds.

By mimicking human interaction with digital interfaces, RPA ensures accuracy, reduces processing delays, and frees human capital for higher-value analytical work. In enterprise settings, RPA-driven Autofinance tools reduce manual effort by up to 70%, according to industry benchmarks. “Automation eliminates the grind,” observes Martin Cole, lead automation specialist at Corporate Finance Solutions.

“Teams no longer waste hours on data entry; instead, they focus on strategic forecasting, client engagement, and innovation.” Cloud Integration and Real-Time Data Flows Autofinance thrives on seamless connectivity across disparate financial systems—from ERP platforms and banking APIs to accounting software and investment trackers. Cloud-based architectures enable secure, scalable data aggregation, allowing Autofinance platforms to deliver unified, real-time views of an organization’s or individual’s financial health. This interoperability supports instant reconciliation, cross-platform analytics, and regulatory compliance monitoring.

“Cloud infrastructure is the backbone of modern Autofinance,” says Autofinance platform strategist Yasmin Patel. “It enables scalability, resilience, and the power of networked intelligence—transforming fragmented data into a coherent, strategic asset.”

Practical Applications Across Personal and Professional Finance

From individual budgeting to institutional finance, Autofinance delivers measurable benefits through targeted automation.For consumers, Autofinance powers smart budgeting apps that categorize spending, set consumption limits, and send proactive alerts—helping users avoid overspending and build savings discipline.

These platforms learn from user habits, identifying patterns such as recurring subscription costs or seasonal spending spikes, and suggest tailored adjustments.

In the corporate realm, Autofinance transforms treasury and accounting operations. Automated month-end close processes reduce errors, accelerate financial close timelines, and improve transparency. Predictive analytics within Autofinance tools forecast liquidity needs, stress-test balance sheets under various scenarios, and optimize working capital.

Global firms using Autofinance systems report up to 50% faster reporting cycles and enhanced risk visibility.

Security and Ethical Considerations in Autofinance

As Autofinance handles sensitive financial data, robust security measures and ethical frameworks are paramount. End-to-end encryption, multi-factor authentication, and real-time anomaly detection protect against breaches and unauthorized access. Yet, the reliance on AI also raises concerns about algorithmic bias, data privacy, and transparency.Industry leaders emphasize the need for

Related Post

Zipper Nicknames: The Authentic Names People Use That No One Talks About

Lillian Cunningham Podcasts Bio Wiki Age Wedding Salary And Net Worth

Unpacking The Notorious: Precisely How Tall Is Conor McGregor?

The 2021 Toyota Camry Black Edition: Where Power Meets Timeless Elegance