Artha Finance Indonesia: Decoding the Engine of Financial Innovation in Southeast Asia’s Core Market

Artha Finance Indonesia: Decoding the Engine of Financial Innovation in Southeast Asia’s Core Market

भारत, Indonesia’s financial landscape is undergoing a pivotal transformation, led by forward-thinking institutions shaping the future of investment, fintech, and sustainable capital deployment. Among them, Artha Finance Indonesia stands as a paradigm of strategic integration—bridging traditional finance with cutting-edge digital solutions while anchoring growth in Southeast Asia’s largest economy. This comprehensive overview explores the institution’s evolution, core offerings, market impact, and the broader implications of its role in Indonesia’s financial ecosystem.

Artha Finance Indonesia is not merely a financial intermediary—it is a catalyst for inclusive growth, technological adaptation, and responsible investing in one of the region’s most dynamic markets. With a focus on transparency, innovation, and long-term value creation, the firm combines deep local insight with global best practices to serve diverse clients across corporates, institutional investors, and retail investors. ## The Genesis and Strategic Evolution of Artha Finance Indonesia Artha Finance Indonesia emerged from a vision to modernize Indonesia’s financial infrastructure by addressing critical gaps in access, efficiency, and sustainability. Founded in alignment with Indonesia’s Finance Ministry initiatives promoting digital financial inclusion, the entity quickly distinguished itself through a hybrid model blending venture-backed financial technology with conventional banking strength.

From its inception, the firm prioritized three pillars: - **Digitization of financial services**: Developing scalable digital platforms to streamline access to credit, investment, and advisory tools. - **Inclusion-driven products**: Crafting financial solutions tailored to underserved segments, including SMEs and unbanked urban populations. - **Sustainable finance integration**: Embedding ESG criteria into investment strategies to support climate resilience and green growth.

“The core mission of Artha Finance Indonesia is to democratize finance without compromising on rigor or sustainability,” stated Senior Director Rina Putri, head of corporate strategy, during a 2023 industry forum. “We’re not just enabling transactions—we’re reshaping how capital flows in Indonesia’s economy.” ## Core Business Segments and Innovative Financial Tools Artha Finance operates across several interconnected business segments, each designed to meet evolving market demands and regulatory standards. ### Corporate and Institutional Finance Serving a rapidly expanding cohort of mid-sized enterprises (SMEs) and blue-chip corporations, Artha Financial Offers bespoke credit facilities, structured financing, and risk management solutions.

Using AI-driven credit scoring models, the firm has reduced underwriting timelines by over 60%, enabling fast capital deployment. - **Dynamic Trade Finance Solutions**: Real-time documentation and blockchain-backed transaction trails have minimized fraud risks and accelerated supply chain liquidity. - **Green Bonds and Sustainability-Linked Loans**: Aligning with Indonesia’s climate agenda, these instruments unlock low-cost capital for renewable energy and eco-infrastructure projects while meeting international ESG benchmarks.

### Retail Finance and Digital Empowerment The retail arm leverages mobile-first platforms and AI-powered personalization to engage millions of individual investors. - **Smart Investment Tools**: Machine learning algorithms offer real-time portfolio optimization, automated rebalancing, and educational content to cultivate financial literacy. - **Micro-Investment Ecosystems**: Low-fee, fractional share trading and green fund subscriptions lower entry barriers, democratizing access to wealth-building vehicles previously limited to affluent clients.

- **Banking-as-a-Service (BaaS) Platform**: Integrating with third-party fintechs, Artha enables partner networks to embed lending, payments, and wealth services into non-financial apps—expanding financial reach into everyday digital interactions. ### Fintech Integration and Digital Infrastructure At the technological heart of Artha Finance Indonesia is a robust digital infrastructure built on cloud-native architecture and open banking APIs. - **API-First Architecture**: Enables seamless data exchange with regulators, payment gateways, and external service providers, supporting rapid innovation and compliance automation.

- **AI and Predictive Analytics**: Powers fraud detection, client segmentation, and macroeconomic forecasting, enhancing operational resilience and strategic decision-making. - **Blockchain for Trust and Transparency**: Piloting applications in trade finance, digital identity verification, and audit trails to reduce transaction friction and strengthen stakeholder confidence. ## Market Position and Socioeconomic Impact In a market increasingly defined by digital disruption and rising retail participation, Artha Finance Indonesia ranks among the top five fintech-focused financial entities by transaction volume.

Its influence extends beyond financial metrics: - **Financial Inclusion Gains**: Over 1.2 million previously unbanked or underbanked customers have activated digital financial accounts, many through mobile-enabled KYC processes. - **SME Growth Catalyst**: Over IDR 5 trillion ($320 million) in financing disbursed since 2020 has fueled expansion, innovation, and job creation across manufacturing, agribusiness, and digital services. - **Policy Alignment and Industry Leadership**: Regular collaboration with Bank Indonesia, OJK (Financial Services Authority), and ASEAN Central Banks positions Artha as a de facto standard-setter in responsible fintech governance.

“Artha Finance doesn’t just respond to change—they anticipate it,” noted Dr. Via Hadipsari, senior economist at the Jakarta Institute for Financial Research. “Their model proves that profitability and social impact can coexist, setting a new benchmark for the region.” ## Challenges and the Path Forward Despite strong momentum, Artha Finance Indonesia faces persistent challenges: regulatory fragmentation across jurisdictions, cybersecurity threats, and the need to balance innovation pace with client protection.

To address these, the firm is investing heavily in: - **Robust Compliance Frameworks**: Deploying real-time monitoring systems and AI-based compliance engines to stay ahead of evolving regulations. - **Cybersecurity Fortification**: Partnering with leading tech security firms to protect sensitive financial data and maintain trust. - **Client Education and Support**: Expanding multilingual digital literacy programs to empower users and reduce financial exclusion rooted in knowledge gaps.

Looking ahead, Artha is poised to deepen its footprint not only within Indonesia but across Southeast Asia’s interconnected financial corridors. Strategic partnerships with regional fintech hubs—particularly in Vietnam, Thailand, and Singapore—are already underway, aiming to replicate successful Indonesia models elsewhere. The broader implications of Artha Finance Indonesia’s rise extend beyond national borders.

In a region where financial inclusion remains a critical development priority, Artha exemplifies how agile, purpose-driven institutions can accelerate equitable growth while embracing technological frontier. With strong governance, data-driven insight, and a relentless focus on value creation, Artha is not just shaping Indonesia’s financial future—it’s helping define Southeast Asia’s financial blueprint. --- Artha Finance Indonesia stands as a testament to the power of strategic innovation in transforming finance into a force for broad-based prosperity.

By harmonizing technology, inclusion, and sustainability, the country’s leading financial institution is setting a high bar for the next generation of capital markets in emerging economies.

Related Post

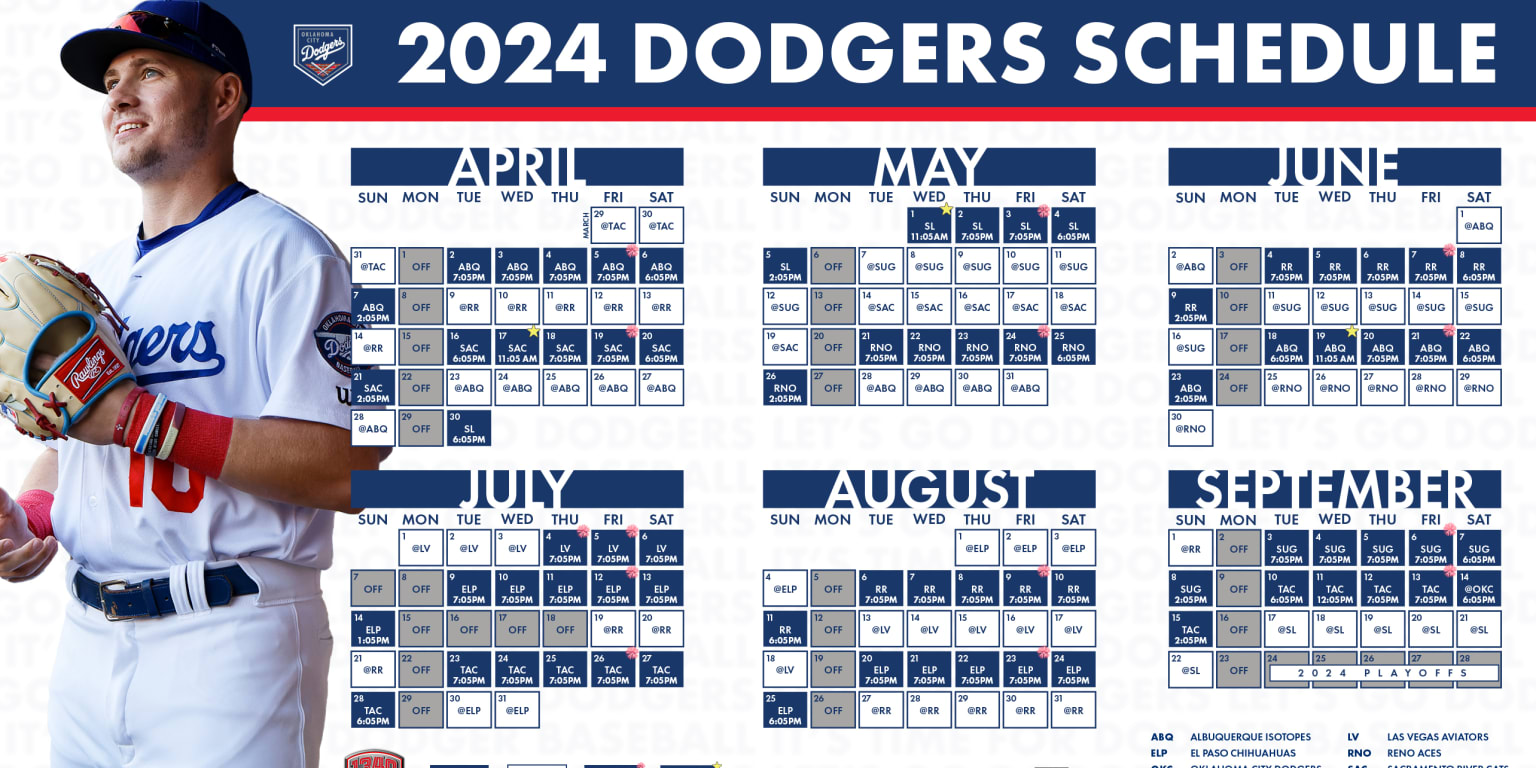

Dodgers 2025 Schedule and Giveaways: Don’t Miss Out on Your Ultimate Championship Countdown

LiAngelo Ball: A Deep Dive into the Basketball Journey of the Middle Ball Brother

What Is the Time Now in Orlando? Your Real-Time Answer with Precision