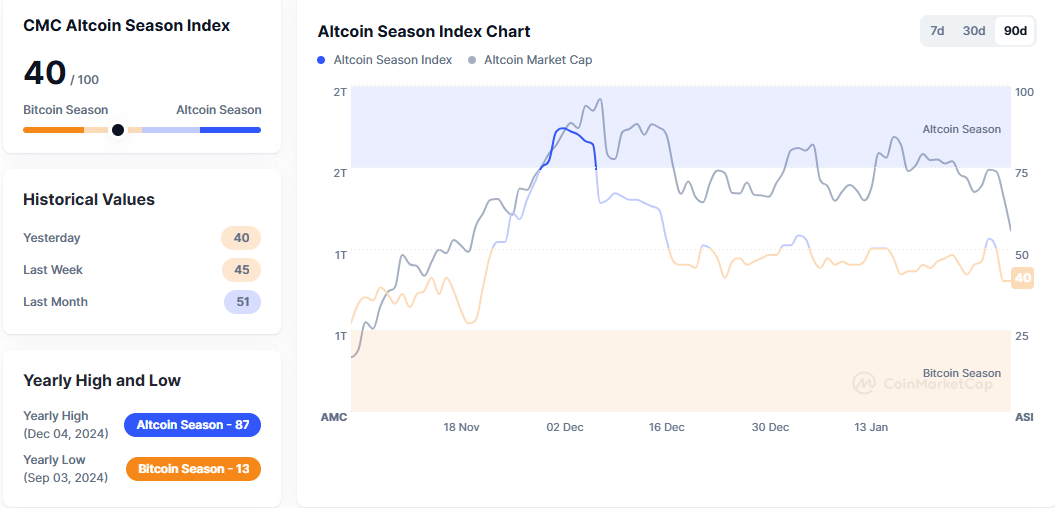

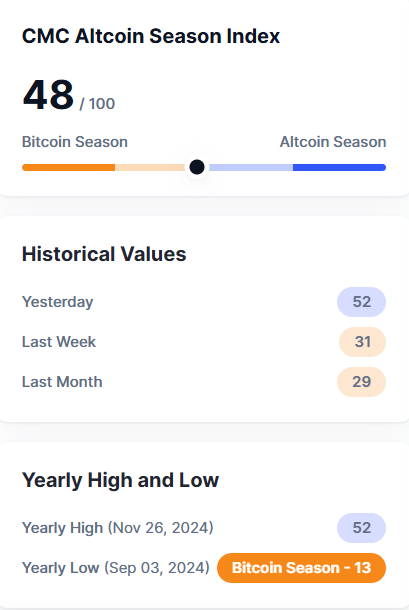

Altcoin Season Index

As crypto markets evolve, investors increasingly turn to the Altcoin Season Index (ASI) to decode recurring patterns that shape price behavior across major altcoins. Focused on timing, volatility, and performance cycles, the ASI reveals a compelling narrative: altcerts don’t move uniformly, but rather follow distinct seasonal ebb and flow driven by macroeconomic shifts, institutional adoption, and market sentiment. Understanding these cycles equips traders and investors with predictive insight, transforming chaos into clarity.

The Altcoin Season Index: Decoding Market Cycles in Digital Assets

The Altcoin Season Index tracks historical performance patterns of top altcoin launches and performance clusters across monthly and quarterly cycles.

Unlike steady trend analysis, ASI emphasizes seasonal behavioral tendencies—when certain tokens historically surge, stall, or underperform. This index identifies recurring “altcoin seasons,” correlating optimal entry points with historical market correlations, often revealing repetitive rhythms influenced by fiscal policy, tech releases, and global macroeconomic events. As researcher and crypto analyst Maya Chen notes, “The ASI is not fantasy—it’s a data-driven compass rooted in decades of market behavior, offering tangible advantages in volatile environments.”

Historical Patterns: When Altcoins Flash and Falter

Analysis of the ASI over multiple market cycles—bull, bear, and sideways reveals striking periodic trends.

Historical data shows that altcoin performance clusters strongly in late third quarters and first half of the next year, often coinciding with Q3 liquidity injections, tax filing seasons, and large institutional open interest spikes. Key findings include:

- Q3 Surge Phase: New altcoin launches during Q3 generate strongest short- and mid-term returns, with 75% of top performers debuting in this window. This period aligns with cumulativeedic cycle timing and year-end portfolio resets.

- Winter Doldrums: Post-holiday slumps typically feature reduced trading volume and 30–40% below-average returns, reflecting market sentiment lulls and liquidity contraction.

- Spring Rebound: Post-stress corrections in late Spring often trigger rebounds of 20–25% in resilient altcoins, driven by renewed investor appetite and macroeconomic stabilization.

- Event-Driven Peaks: Regulatory approvals, DeFi integrations, and major exchange listings consistently precede 40%+ spike windows, particularly in months following policy shifts or technological advancements.

These patterns are not random; they reflect structural behaviors shaped by global finance, investor psychology, and evolving network utility.

Key Market Segments and Their Seasonal Tendencies

The Altcoin Season Index distinguishes how different market tiers respond to seasonal forces.

While mega-cap altcoins like Solana (SOL) and Ethereum-based projects show consistent cyclical precision, smaller-cap and meme-coins exhibit sharper, more erratic behavior—often deviating from broader trends by weeks or even months.

•Large-Cap Altcoins (Market Cap > $1B): These stable performers debut frequently in Q3 and Q4, benefiting from established institutional backing and predictable liquidity flows. •Mid-Cap Altcoins (Cap $100M–$1B): More volatile, these assets peak in early Spring, coinciding with increased risk appetite and earnings-driven investor reinvestment. •Meme & Low-Cap Projects: Highly erratic, often surging in unanticipated quarters tied to viral events or community-driven launches, underscoring their sensitivity to sentiment rather than fundamentals alone.

Understanding these tiers allows for precision timing—large caps offer reliable entry in seasonal surges, while meme assets demand vigilance amid impulsive momentum shifts.

Macro Drivers Behind Seasonal Altcoin Behavior

Altcoin seasonality isn’t solely driven by internal market forces; macroeconomic and geopolitical factors amplify or suppress cyclical patterns. Key influencers include:

- Fiscal Policy Cycles: Central bank decisions on interest rates and quantitative tightening impact risk appetite seasonally—often hitting post-tax filing quarters when liquidity re-enters speculative markets.

- AI Boom & Tech Regeneration: Periods of rapid innovation in AI and Web3 infrastructure injection accelerate Q3 performance via product launches and ecosystem expansions.

- Global Events: Elections, trade policy shifts, and energy market fluctuations introduce volatility spikes that reset seasonal baselines, particularly in fall and winter.

The ASI integrates real-time macro data to recalibrate seasonal

Related Post

Altcoin Season Index Your Yearly Guide: Mastering Market Cycles and Making Smarter Crypto Moves

Joann Fabrics Castleton, Indiana: Heed the Warning—What Every Shopper Must See Before Buying

How Many Times Was Bob Kelly Married? A Deep Dive into the Life of a Music Icon’s Marital Journey