Aggr8Investing Redefines Commercial Real Estate Ownership with Innovative Business Property Strategies

Aggr8Investing Redefines Commercial Real Estate Ownership with Innovative Business Property Strategies

In a dynamic marketplace where traditional real estate models struggle to keep pace, Aggr8Investing stands at the forefront, offering a transformative approach to business property ownership through its proprietary platform and data-driven investment framework. By blending cutting-edge technology with deep market expertise, Aggr8Investing is reshaping how investors access, manage, and scale commercial real estate assets. The result?

A scalable, efficient, and high-return ecosystem that empowers both institutional and entrepreneurial players to own and leverage business properties with unprecedented precision.

At the core of Aggr8Investing’s value proposition is its end-to-end platform designed specifically for commercial real estate aggradation—aggregating data, streamlining due diligence, and optimizing portfolio performance. Unlike conventional brokers or passive investors, Aggr8Investing functions as a full-service partner, identifying undervalued business properties, assessing cash flow viability, and structuring tailored investment vehicles that align with diverse risk appetites.

“We don’t just trade properties—we architect growth,” states Daniel Reyes, CEO of Aggr8Investing. “Our platform cuts the inefficiencies of traditional deal-making, enabling faster capital deployment and sustained value creation.”

The platform’s strength lies in its meticulous integration of market analytics and proprietary risk modeling. By leveraging real-time data on tenant demand, location analytics, lease dynamics, and macroeconomic indicators, Aggr8Investing provides investors with actionable insights that transcend surface-level valuations.

This analytical rigor translates into smarter decision-making: identifying high-traffic retail nodes, underutilized industrial facilities with upgrade potential, or adaptive reuse opportunities in transitioning urban districts. The outcome is a granular understanding of asset performance—critical for maximizing returns in an era of evolving commerce.

One of Aggr8Investing’s most impactful innovations is its flexible ownership structure.

Recognizing that modern investors demand customization, the firm offers modular investment packages ranging from joint ownership and ground leases to fractional ownership and ROI-sharing trusts. This adaptability democratizes access to prime business properties, allowing smaller firms and individual investors to participate in large-scale opportunities previously reserved for institutional giants. As market analyst Rebecca Chen notes, “Aggr8Investing dissolves the traditional barriers to entry—offering scalability without sacrificing control, transparency without complexity.”

Beyond structural innovation, Aggr8Investing excels in active asset management.

The platform doesn’t merely acquire properties; it retains strategic ownership and implements performance-enhancing upgrades—from sustainability retrofits and tech-enabled building systems to tenant mix optimization. By treating each property as a living investment engine, Aggr8Investing ensures that assets not only hold value but grow it over time. This hands-on stewardship model distinguishes the firm from transactional competitors, positioning it as a long-term partner in real estate success.

Agent narratives underscore the platform’s operational excellence: “Aggr8Investing treats us like experts,” says Marcus Lin, a commercial landlord managing assets through the platform. “They analyze every lease term, forecast foot traffic, and deploy capital where it delivers the highest ROI. Their data helps us avoid pitfalls and seize opportunities with confidence.” These firsthand accounts reinforce a central theme—Aggr8Investing transforms ownership from a static holding into a dynamic growth strategy.

The firm’s technological backbone further enhances efficiency and accuracy. Integrated AI tools automate market scans, lease tracking, and financial projections, reducing human error and accelerating deal cycles. A cloud-based dashboard provides real-time visibility into portfolio performance, enabling swift adjustments in response to market shifts, tenant turnover, or macroeconomic changes.

Blockchain-based transaction records ensure transparency and security, reinforcing trust across all stakeholder interactions.

Aggr8Investing’s strategic focus extends beyond physical assets to the evolving business ecosystems they inhabit. The firm actively identifies properties positioned to benefit from urban regeneration, last-mile logistics hubs, and experiential retail corridors.

By anticipating consumer behavior shifts—such as the rise of omnichannel retail or flexible workspace demands—Aggr8Investing places investments in locations primed for resilience and growth. This forward-looking lens ensures that every acquisition is not just a property purchase, but a strategic bet on future market trends.

From a financial perspective, Aggr8Investing’s model delivers consistent, predictable returns.

Transparent reporting and performance benchmarks allow investors to measure outcomes against market averages, supporting informed capital allocation. Risk mitigation is embedded throughout the process: rigorous tenant screening, dynamic lease structuring, and scenario modeling protect downside while amplifying upside potential. This disciplined approach appeals to risk-aware investors seeking both stability and upward trajectory.

As commercial real estate undergoes rapid transformation—driven by digitalization, sustainability mandates, and shifting workplace cultures—Aggr8Investing emerges as a blueprint for modern ownership. Its fusion of technology, analytics, and investor-centric flexibility creates a competitive edge few firms can match. By democratizing access, enhancing operational value, and aligning with long-term market shifts, Aggr8Investing is not simply managing properties—it’s building enduring real estate empires with precision and purpose.

In a landscape where adaptability determines survival, Aggr8Investing proves that the future of business property ownership belongs to those who build it strategically.

Ultimately, Aggr8Investing redefines what it means to own a business property in the 21st century. It is more than a brokerage platform; it is a comprehensive investment architecture that empowers investors to own smarter, grow faster, and thrive amid change.

Through data, innovation, and a relentless focus on value creation, Aggr8Investing sets a new standard—one that combines institutional rigor with entrepreneurial agility, ensuring that every property becomes a vehicle for sustained success.

Related Post

Casey Durliat Unlocks the Physics Behind High-Octane Performance: A Deep Dive into Force, Efficiency, and Precision

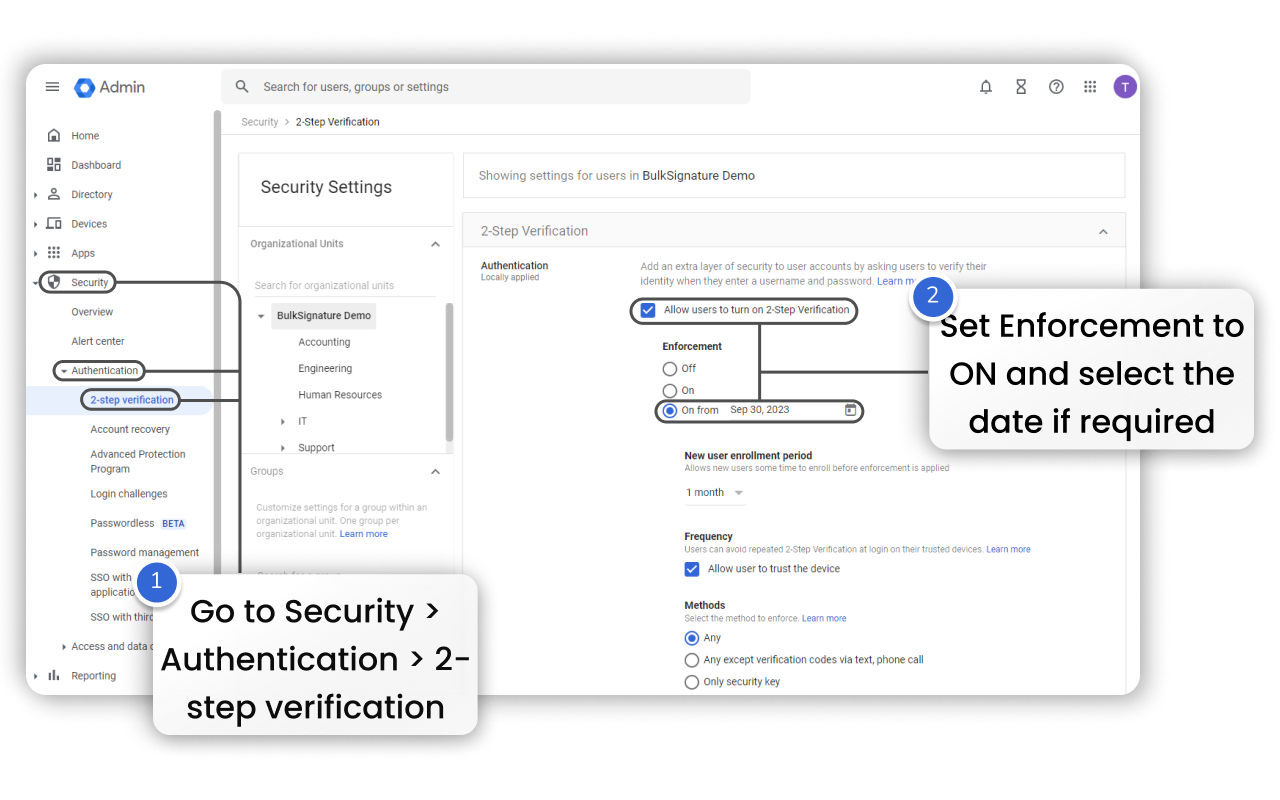

Mastering The Gateway: Become a Pro in theไทย Workspace Admin Console

Rita_Faez: Redefining Innovation Through Visionary Tech Leadership