Activate Your TD Credit Card with the Td App in Seconds—Here’s How

Activate Your TD Credit Card with the Td App in Seconds—Here’s How

Launch the Td App and activate your TD credit card with just a few taps—no bank visit, no paper forms. This streamlined digital process empowers users to take control of their finances, activating one of Canada’s most trusted credit cards instantly from anywhere in seconds. Whether you’re a first-time cardholder or updating your verification, activating your TD Credit Card through the app combines speed, security, and simplicity—transforming a potentially slow administrative task into a seamless experience.

At the core of the activation process is the Td App’s intuitive design, built around convenience without compromising safety. Activating your TD credit card via the app leverages the same robust security measures foundational to modern financial technology, including real-time encryption, biometric authentication, and secure two-factor verification. This ensures sensitive data remains protected at every step—no risk of exposure during activation.

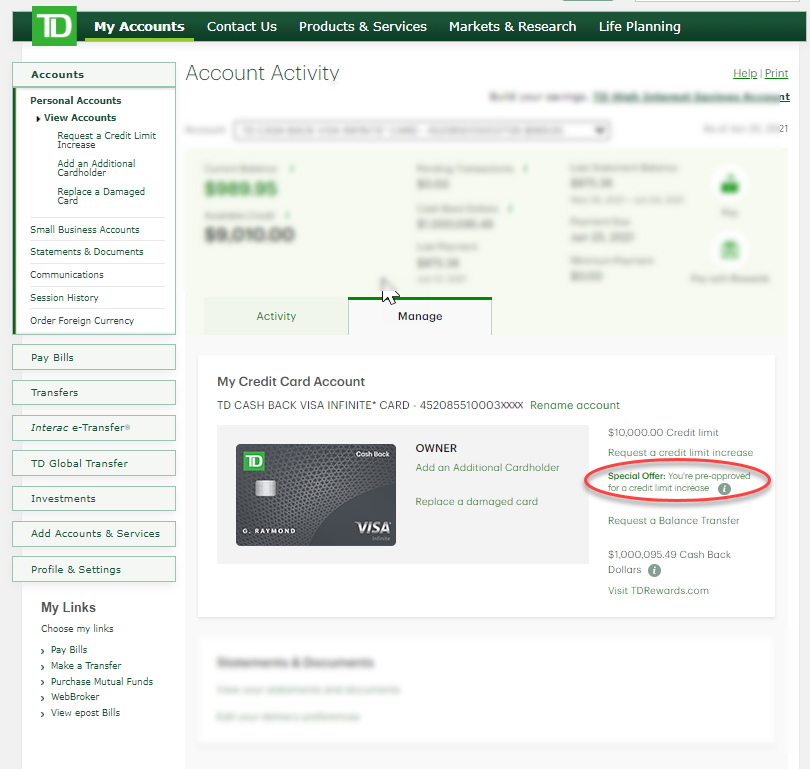

To begin, open the TD App and navigate to the “Activate Card” section, typically found in the main menu under “Cards” or “Account Services.” From here, select your TD Credit Card from the list of eligible cards—most standard consumer or premium TD credit offerings are supported. The system verifies your identity using either your registered phone number or email, often followed by a one-time password (OTP) sent to your device or a push authentication prompt. Once confirmed, the card is activated within minutes, instantly available for point-of-sale use, online purchases, or cash advance requests.

One of the key advantages of digital activation is the elimination of physical wait times and paperwork.In traditional credit card activation, customers faced in-branch queues, waiting weeks for physical cards to arrive and documents to process—delays that frustrated many users. Now, with the Td App, activation is as quick as logging in: no visits, no approvals, no postal delivery. Users report activation completing in under five minutes from authentication to card availability—transforming a once tedious task into a frictionless step in financial empowerment.

Key Features Enhancing Your Experience

- Real-Time Notifications: Immediately after activation, recipients receive push alerts confirming the card’s status, including issuance date and initial credit limit visibility. - 24/7 Accessibility: Activation is available anytime, day or night—no bank hours restrict your ability to start using your card. - Cash Advance & Online Use: Once activated, the card instantly supports consumer purchases, bill payments, cash advances, and digital wallet integrations.- Biometric Authentication: Enhanced security via fingerprint or face ID ensures only authorized users activate and access the card. - Powerful Customer Support Integration: Should issues arise—such as failed verification or system glitches—Td’s support team is reachable within minutes via in-app chat or phone.

For users transitioning from paper-based activation or previously facing login challenges, step-by-step onboarding within the Td App guides through each verification stage.

Clear progress indicators reduce anxiety, while tooltips explain required inputs—from date of birth to municipal address—minimizing errors. The app’s UX design ensures even first-time smartphone users can navigate activation without confusion.

Activating a TD credit card through the Td App also strengthens financial inclusion. With digital access, users in remote areas or those with limited mobility access credit services previously constrained by geographic or physical barriers.This democratization of financial tools aligns with TD’s broader commitment to inclusive banking—leveraging technology not just for convenience but for equity. Security remains paramount. The app employs bank-grade encryption (128-bit SSL and tokenization) to protect personal and financial data.

Tokenization replaces sensitive card details with unique identifiers during transactions, shielding information from interception. Biometric logins add a critical layer of fraud prevention—making unauthorized access virtually impossible even if device credentials are compromised. For added protection, Td implements behavioral analytics, flagging unusual activity post-activation to rapidly respond to potential threats.

Post-activation, monitoring card activity through the Td App is effortless. Live transaction alerts, spending categorization, and automatic fraud monitoring provide users real-time insights, helping maintain control over credit usage. The app also supports quick reporting of lost cards or suspicious charges—ensuring rapid response and minimizing risk.

Real-world user experience underscores the system’s effectiveness: feedback consistently highlights accuracy, speed, and clarity.“I activated my new TD credit card late one evening, and within seven minutes, the card showed up digitally—no mail, no risk,” one Td customer shared. Another noted, “Activating felt fast and safe—biometric lock and instant OTP checks made it trustworthy.”

In sum, activating your TD Credit Card via the Td App represents a modern standard in credit card onboarding—where digital innovation converges with rigorous security and user-centric design. From initial login to instant activation, every step is engineered for speed, clarity, and protection.This streamlined process not only transforms how Canadians access and manage credit but also sets a benchmark for financial app functionality nationwide. With the Td App, activating your card is no longer a hurdle—it’s the first step toward greater control, privacy, and financial empowerment.

Related Post

Andy Richter’s Stature: The Real Height Behind the Charismatic Actor

Kurt Angle Devastated By Sisters Death a Day Before Epic Match Against Brock Lesnar

Erica Deutschman Age Wiki Net worth Bio Height Boyfriend

Erome’s Latest 12: A Game-Changing Leap That Redefines the Boundaries of Digital Intimacy